Artificial Intelligence (AI) Agents: Crypto Catalyst

Bitcoin approaches its all time high as AI Agents proliferate the market; infrastructure enables users to deploy their own Agents in a matter of minutes. Is this the catalyst crypto needs?

I’ll use a decade of traditional finance/corporate experience to refine the chaos into bite-sized chunks for you to digest

This newsletter consists of three parts:

Snippet Partner (Modern Market)

Market Overview

Headline News

Enjoy the journey and if you have any questions feel free to reach out to me on X

The “Modern Market” Show is a live daily show on the NFT market, the crypto market, and how to make money on the internet

Live on X and YouTube from Monday to Friday at 7 am ET, running for 60 minutes

Tune in to better understand the latest trending matters across the market

This newsletter goes out weekly to 3.9k subscribers

Please don't hesitate to message me directly for sponsorship or partnership enquiries

Bitcoin pumps beyond $71k ($2k off all time highs) as the Presidential Election results fast approach on November 5th:

But the Election results are not the event bringing eyes to crypto:

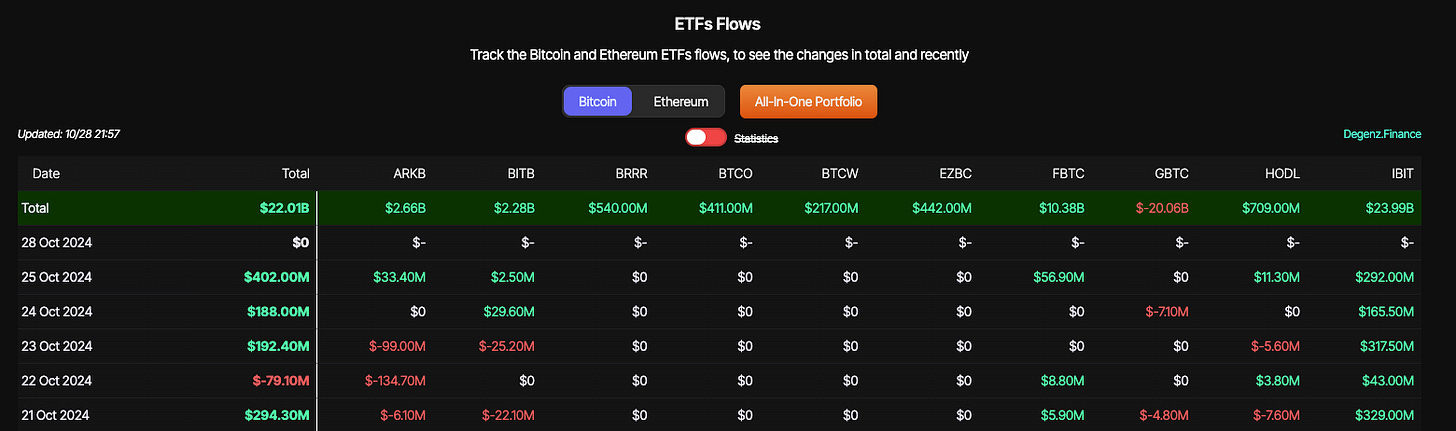

Bitcoin ETF net aggregated inflows total $1 billion this week as the overall ETFs near 1m BTC under management:

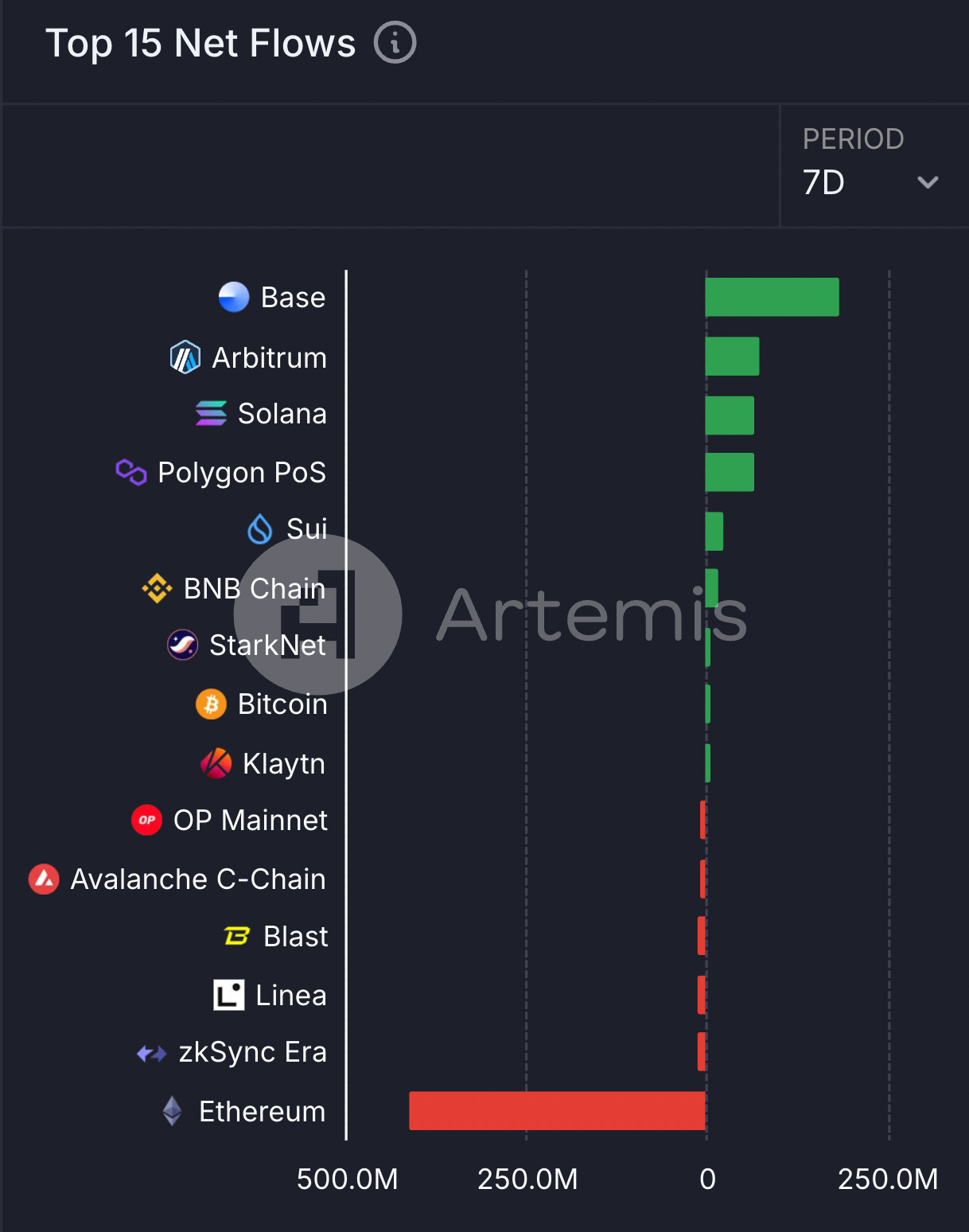

Meanwhile, the programmable money struggles as Vitalik writes his 5th blog on the future of ETH; This fails to have a positive impact on the price as ETH continues to decline, with the ETHSOL ratio deteriorating further:

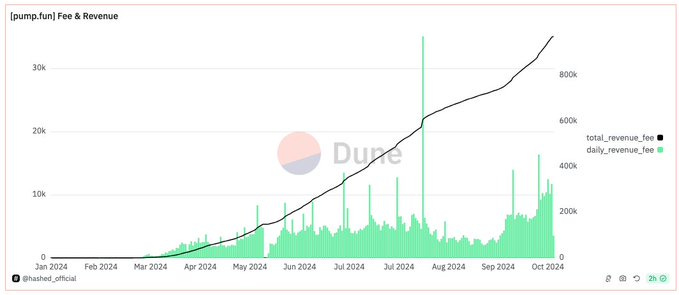

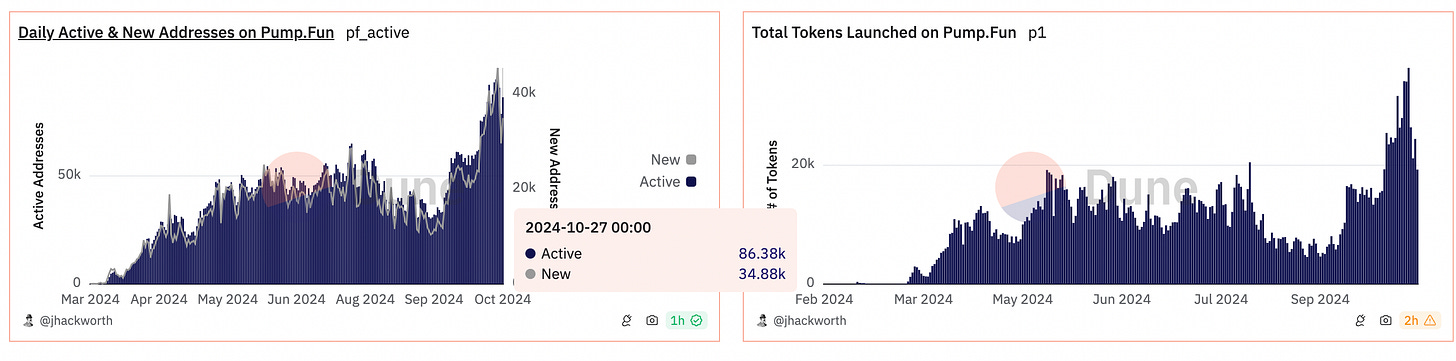

SOL flips ETH for 24hr fees while PumpFun makes $78m of SOL in fees

This continued strengthening in Solana activity is unsurprising as PumpFun introduces tokenised video memes and daily analytics for new users on the platform continue to climb

> 20k new Pump tokens are launched daily, acting as a deflationary burn to Solana as the Liquidity Pools for each of the tokens that graduate to Raydium are burned — its no wonder Raydium flips ETH for 24 hour fees

Artificial Intelligence (AI) Agent Proliferation

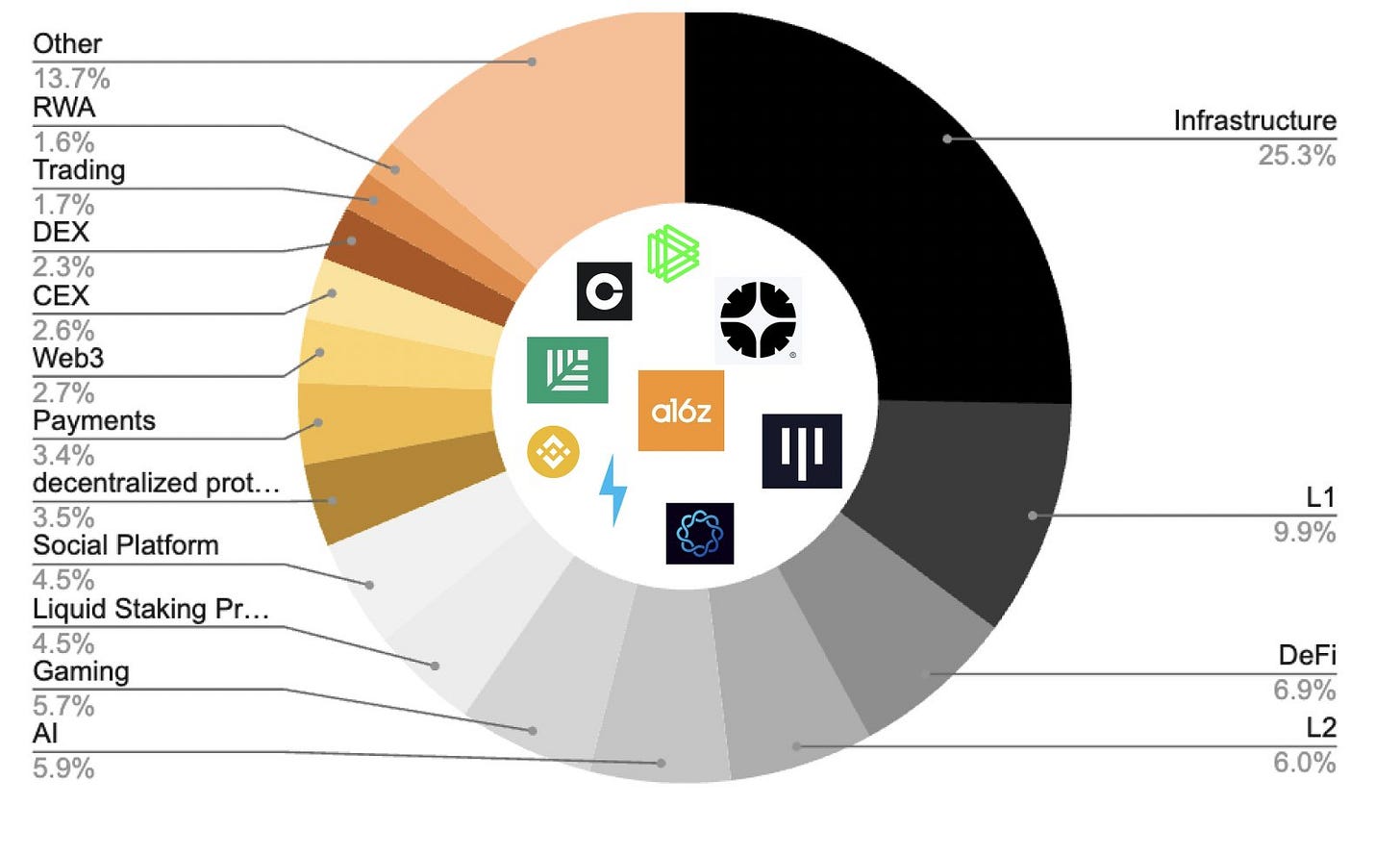

AI agents continue to dominate sentiment in crypto; the AI narrative has been heating up in 2024 with a $34bn market cap:

This feels undervalued in my opinion when comparing to the meme coin market cap which hits new local highs of $64.5bn:

Once Bitcoin breaks all time highs I suspect utility coins, and specifically AI, will receive attention

I covered the Terminal of Truth and AI GOAT meme a couple of weeks ago

The AI x Crypto intersect has levelled up with the proliferation of AI Agents:

Truth Terminal joins Fantasy Top & debuts an AI KOL competing against Humans

Coinbase introduces AI agents ‘in 3 minutes’ as First on-chain transaction made by AI agent on Base

Since then some interesting developments have come to market:

AI Agents are running DAOs as autonomous investment vehicles, using machine learning to iterate and improve their investment portfolio thesis which could lead to PVP in the AI Arena:

ai16z hit $75m after being retweeted by Marc Andreessen and degenAI hit $20m, with original token (Ruby) discovered that was created by the ai16z founder

We are even seeing Defi Platforms being established specifically for AI Agents with Almanak — AI deploy Defi strategies to optimize for returns using machine learning:

The intersect between AI x Crypto is evolving at an exponential rate — So i’ll do my best to keep readers abreast of these developments as they land

Follow me on X to receive real time updates and a deeper analysis here

NFT Market Volume

NFT volume is up on Solana but down on ETH/BTC:

Ethereum NFTs:

Murad linked NFT projects (Milady, Aeon, Sproto) rise led by Apu Apustajas which minted earlier in the week and are yet to find fair value

Sprotos and other meme NFTs have hit multi ETH floor prices; Apu has potential?

Bitcoin Ordinals/Runes

Bitcoin Ordinal Volume dips but prices rise on a the main collections:

Bitcoin Puppets (+14%)

Quantum Cats (+13%)

Nodemonkes (+3%)

Mintify also launches its Bitcoin keys which unlock a raft of benefits as their anti sniping features level up the bitcoin ordinal trading infrastructure UX

Solana: $5.7m of the volume is attributable to the Frogana collection which is notorious for Tensor farming

Hot NFTs include DeGods and Retardio:

Retardios continue to sustain a reasonably high floor price during the meme attention cycle despite a slight sell off

Notable NFT Sales

Several Punks trade over $100k while Gondi refinances a number of Autoglyph loans:

New Participant Indicators

Pudgy Penguins go live in Walgreens (4k more stores for Pudgy Plushies)

Buenos Aires builds decentralised ZK ID solution (3.6m Citizens)

Base stablecoin transfer volume flips ETH & SOL (The killer crypto application)

Open Interest hits ATH of $33bn on BTC (Outside interest pushing new ATH)

Institutional Developments

Crypto Headwinds

(H/t Mando’s Minutes)

That’s a wrap for issue 96 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

And if you thought this was interesting, please consider subscribing to this Substack and following me on Twitter for more on NFTs and Web 3.0.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets mentioned in this newsletter.