VC Backed Ai Memes

Memecoins hit a $54 billion market cap (2.3% of all crypto). NFT volume surges, driven by meme-related assets and institutional interest grows as Venture Capital backed Ai bots emerge

I’ll use a decade of traditional finance/corporate experience to refine the chaos into bite-sized chunks for you to digest

This newsletter consists of three parts:

Snippet Partner (Modern Market)

Market Overview

Headline News

Enjoy the journey and if you have any questions feel free to reach out to me on X

The “Modern Market” Show is a live daily show on the NFT market, the crypto market, and how to make money on the internet

Live on X and YouTube from Monday to Friday at 7 am ET, running for 60 minutes

Tune in to better understand the latest trending matters across the market

This newsletter goes out weekly to 3.9k subscribers

Please don't hesitate to message me directly for sponsorship or partnership enquiries

Bitcoin rallies 13% from the pico lows this week as the Presidential election results approach on November 4th (a little over two weeks away):

Bitcoin ETF inflows are a contributory factor to the positive price action this week as $348.5m is scooped up by Institutional buying pressure:

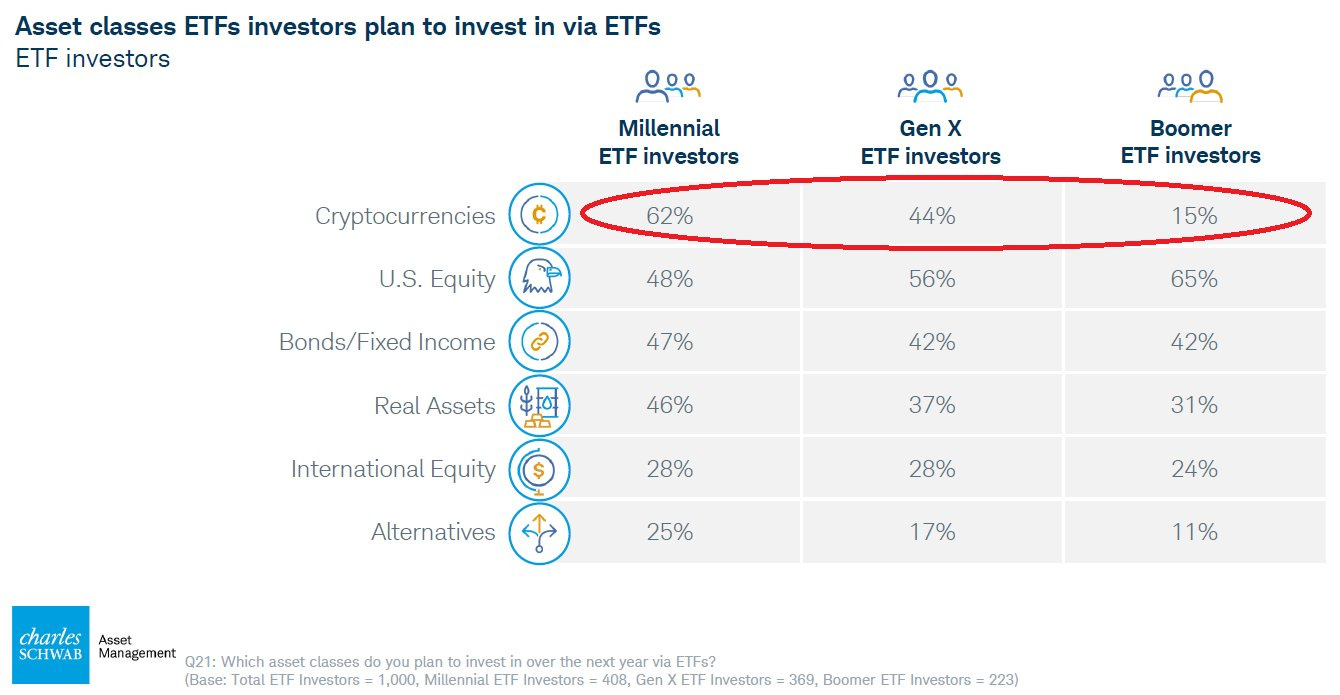

But this is likely to increase as S. Korea reviews its ban on BTC ETFs and Gen-Z (Millennials) inherit generational wealth from Boomers:

Memes hit $54bn; the highest total meme market cap since June 12th — this now equates to 2.3% of the overall crypto market cap:

In March we saw $150m raised across 33 Solana pre-sale ICOs:

Some have performed reasonably well — in fact if you had put 1 Solana ($152) into each of them then you would have achieved a return of 3,100% (31x):

But most of this value capture was with BOME, which was one of the early catalyst ICOs — if you’d missed BOME and chased the rest you would have been up 200% (2x)

Probably even a loss if you’d continued to chase every other pre-sale

BOME is the standout leader with a FDV of $684m = 44,462% (444x) or even higher at the highs around the Binance listing 3 days after launch:

Could we see the same reoccur this time?

Goatse has gone parabolic over the past few days as a new narrative around Ai bots that scour social media platforms to form investment/trading thesis emerge:

There’s opportunity in abundance within the memecoin market — but I’ll continue to be selective about which ones I enter and ensure I have an informed investment thesis for each — BOME was a huge win for me for this very reason

It feeds into the idea that there is a strong community, or cult, around the project — which is aligned with Murad’s cult thesis. But this idea isn’t new

Many trade differently, my preference is fundamentals but others use momentum or narrative — it’s just important that you know what your thesis is

NFT Market Volume

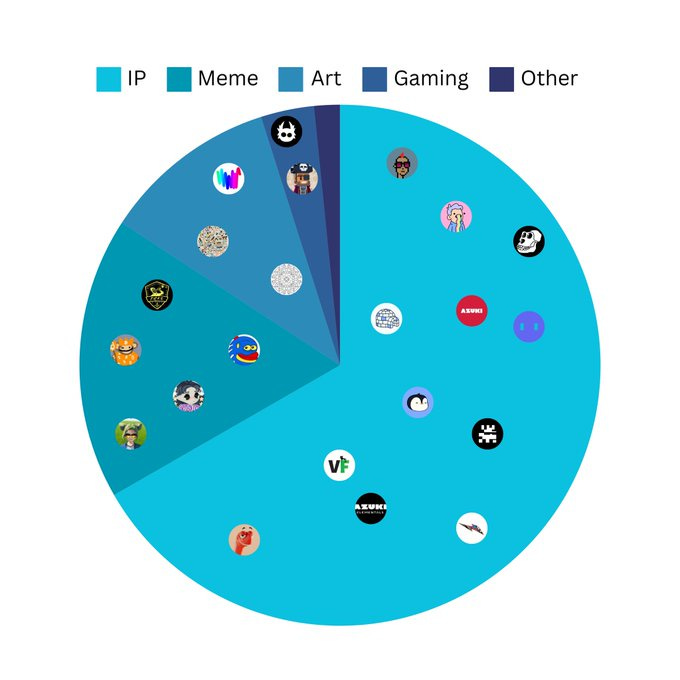

NFT volume is up across all three top chains, with meme NFTs leading the charge:

The catalyst? Murad’s bull posting on the memecoin super cycle thesis:

Ethereum NFTs:

ETH NFTs linked to memes outperform:

Bitcoin Ordinals/Runes

PUPS hits $160m, continues to lead bounce in Runes and four ordinal collections are included on the Murad NFT list, including:

Notable NFT Sales

VR, Top Hat CryptoPunks and a golden BAYC all sell for 6 and 7 figures, respectively

New Participant Indicators

AVAX’s Off The Grid beats Fortnite for downloads and experiences more than 1 million wallets created in just a few days

Here we can see over 3.6m transactions on Avalanche in a single day:

Argentina overtakes Brazil for crypto inflows as Latin America dominates receipts

Institutional Developments

Mocaverse’s $MOCA token included in Venture buy investment thesis

World Liberty Financial public sale on Oct 15th; aims to raise $300m

Deekay Motion gets his wallets hacked but subsequently recovers funds

(H/t Mando’s Minutes)

That’s a wrap for issue 94 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

And if you thought this was interesting, please consider subscribing to this Substack and following me on Twitter for more on NFTs and Web 3.0.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets mentioned in this newsletter.

thanks Sammy!

what about RWA?

if this can be linked with NFT or tokenized something?