$90k Bitcoin: The Rocket’s Launched, but Where’s the Landing?

Bitcoin hits $90k, back in price discovery—where’s the top? Key indicators could signal when the selling may begin.

I’ll use a decade of traditional finance/corporate experience to refine the chaos into bite-sized chunks for you to digest

This newsletter consists of three parts:

Snippet Partner (Mocaverse)

Market Overview

Headline News

Enjoy the journey and if you have any questions feel free to reach out to me on X

This edition of S4mmy’s Web3 Snippets is brought to you in partnership with Mocaverse. As the Research in Residence for this Animoca Backed flagship project I am a strong advocate of their vision of interoperability

The first Moca List partner drop with 0G Labs went live for $MOCA stakers — if you want exposure to Decentralized Artificial Intelligence (AI) then the 0G Labs AI Alignment Nodes provide interesting incentives

Use code “MLS4MMYETH” for a 5% discount — The code works until the end of the Public Sale tomorrow

This newsletter goes out weekly to 4k subscribers

Please don't hesitate to message me directly for sponsorship or partnership enquiries

Bitcoin price action goes parabolic following the conclusion of the Presidential Election results as Trump is anticipated to be inaugurated in January

A 35% increase this week as Bitcoin hits $90k before cooling off:

There was $38 billion in trading volume on Bitcoin related products:

The BlackRock BTC ETF has now surpassed the gold ETF and the Silver market cap:

On the corporate side:

MicroStrategy now owns over $20bn BTC, acquiring $2bn more BTC at the market price

Governments weigh in as a proposal surfaces for the U.S. government to acquire 200k BTC per year for the next five years; this would lead to them owning 6% of the total supply by 2030

The U.S. is already the leader with 213k Bitcoin held — the total BTC held by governments is 2.2% of the supply, but could this increase?

Indicators to Pay Attention to:

Pay attention to objective indicators for when the market shows signs of turning:

Global Liquidity (M2 Supply as a Proxy)

Tracking certain correlated assets or metrics — the M2 supply (3 month offset) is incredibly correlated to the price of Bitcoin:

What does this mean?

It’s essentially a proxy for global liquidity - a thesis that Lyn Alden and Raoul Pal share, whereby liquidity becomes available in the market and is invested into assets, hence the 3 month lag to make these economic decisions

This correlation suggests that we could see $100k Bitcoin before the end of the year — provided it continues to track M2 and does not deviate significantly

Fear and Greed index (69, Nice) - Link

Be mindful of the methodology of each index, some are more sensitive than others — Coin Stats has a pretty decent solution that “feels” right with how the market is

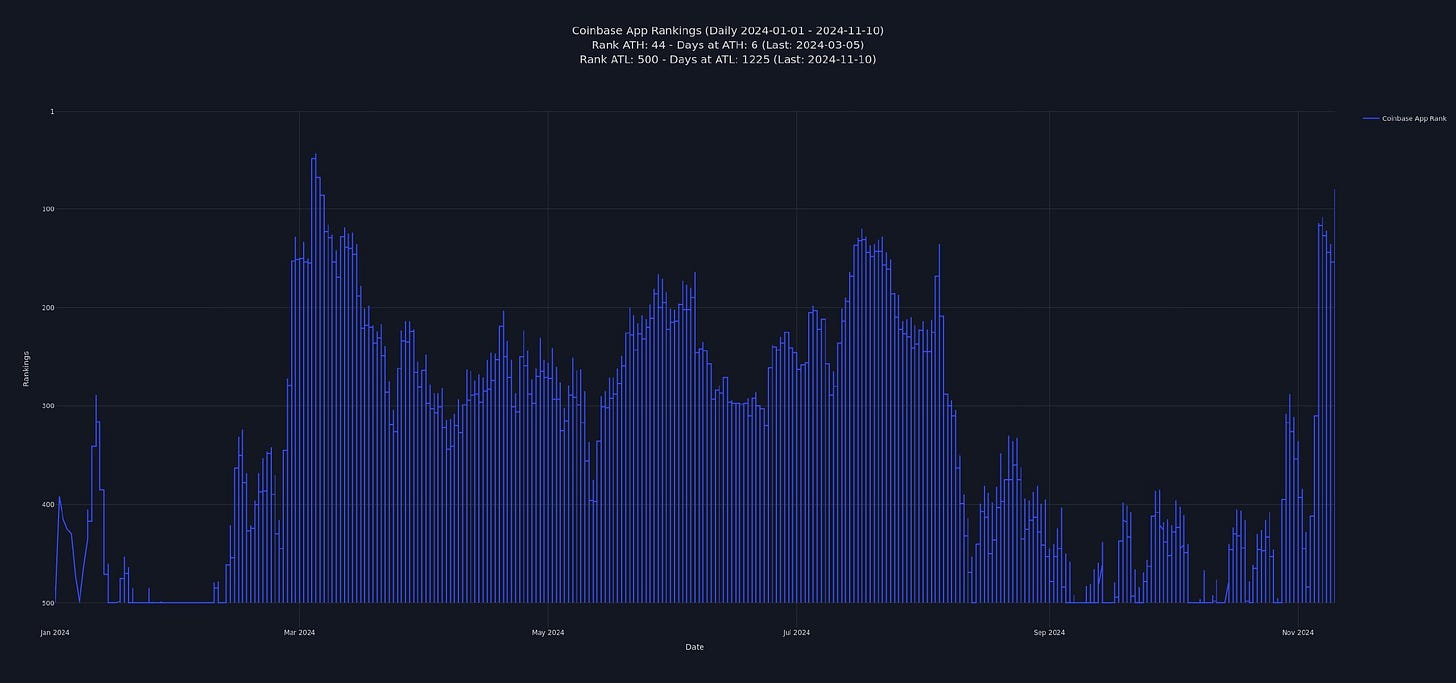

Coinbase wallet downloads up 12%/24h - Link

Historically a top indicator when this is the leading app on the Apple store or Google Play — certainly worth paying attention to

Currently rank 81 in the Apple Store

Google Search Trend for Bitcoin at “79” - Link

This is an interesting one, as we do not know for certain where the “new 100” could land — so even though it’s 79% of the search highs in May 2021, there could be significantly more this cycle as more end users enter crypto

Frothy Venture Capital Crypto Funding Levels - Link

We can at least see the general trend upwards in funding so may be able to pre-empt close to the top when these levels approach or exceed the October 2021 of $7bn

Bitcoin topped in November 2021, so could suggest there are a couple of months lag

Exchange flows fairly neutral - Link

Huge volatile spikes in net flows for exchanges around top/bottoms. Currently the flows are fairly neutral, suggesting many are comfortable holding spot or keeping on chain and in the crypto markets

Crypto YouTube Views

As retail traders see bitcoin and crypto proliferate major news channels, the crypto channels could become a focal point for on-crypto natives to source information

Counter trading mainstream media could also be a useful method to selling close to the top — The Rolling Stones was fantastic for the bottom of the NFT bear market

Other indicators:

The lag between Bitcoin Halving and historical all time high — the supply shock is hard coded into the demand dynamics of the market, BTC miners also hold a significant amount of inventory

Technical Analysis Indicators: RSI, Pi, MACD suggesting that certain crypto assets could be over sold/under bought

Market Value to Realized Value Ratio: A ratio of 3.7 has typically illustrated a crypto cycle top. Market price needs to be reviewed against realized value (weighted average of the last on-chain move price)

Refer to the latest Modern Market episode for a broader discussion on this:

I will pull together an analysis over time to track these metrics, and update you each week — stay tuned

Decentralized AI Corner

I’ve covered the decentralized Artificial Intelligence (AI) landscape in previous newsletters — the space moves quickly so I’ll provide you with weekly updates

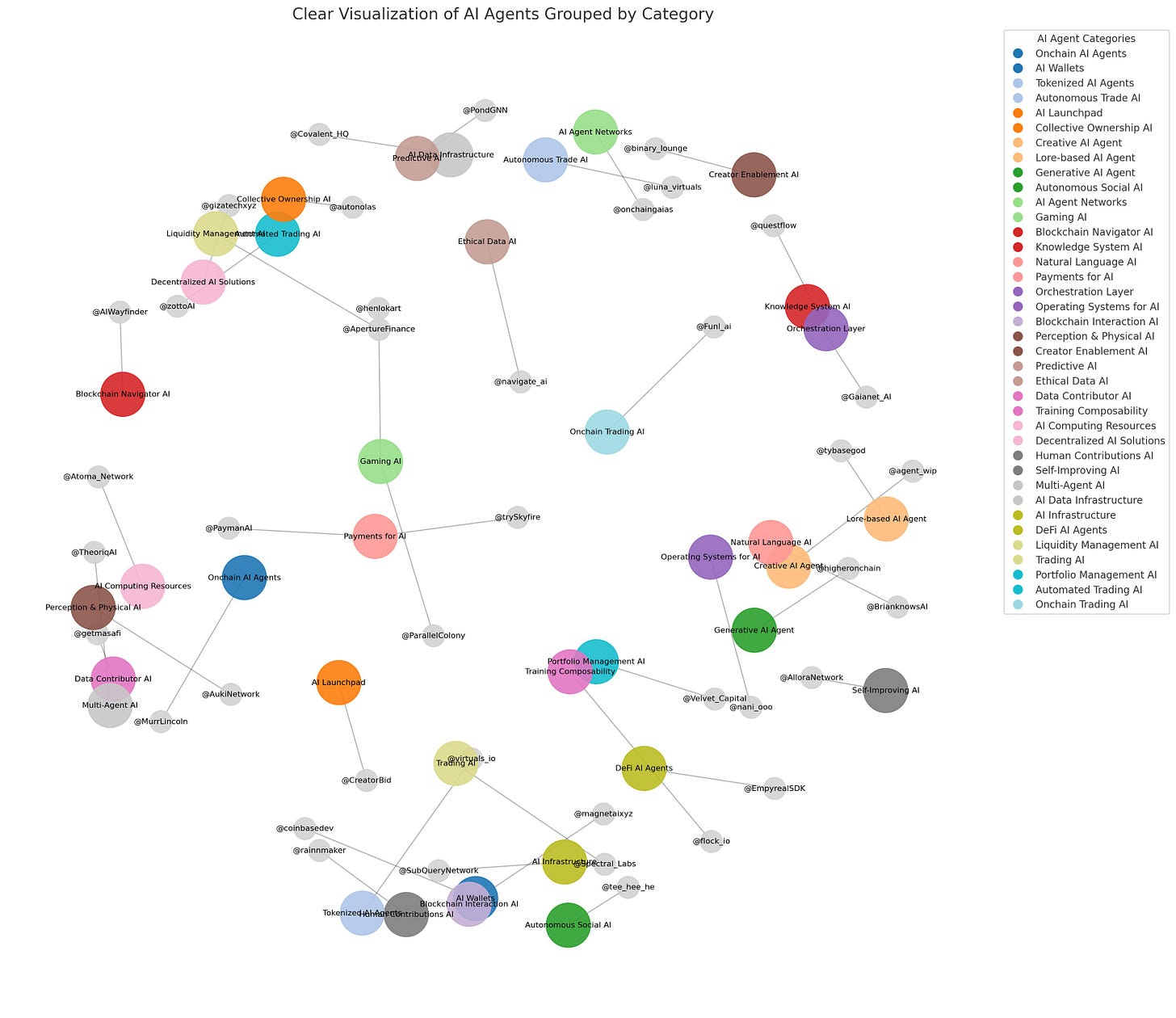

Sandra Aleow created an awesome visualization of the AI landscape on Base:

Since last week the following news has emerged:

0G Labs Node Sale finishes Nov 13th — see 5% discount code MLS4MMYETH

AI Agent (Zero Bro) launches NFT collection for 0.1 SOL each

Prime Intellect’s INTELLECT 1 achieves a major milestone with 50% completion of training for their 10B parameter decentralized AI model

Spectral Labs explores fully autonomous AI agents with Hyperliquid access, allowing token-gated communities to govern agents capable of leveraged trading

Theoriq AI partners with Cluster Protocol to streamline AI agent workflows and template development

Allora Network unveils the Allora Model Development Kit, facilitating fast, efficient machine learning model creation

Oasis Protocol surpasses 100k users on their Chrome extension as they advance their AI-driven, distributed supercomputer for AI inference

Autonomous_AF launches Bottega, the first DEX on AO designed for autonomous agents, supporting advanced orders like DCA, trailing stops, and more

Aelf Blockchain transforms its Telegram sidechain into a dedicated dApp chain, with plans to integrate AI capabilities across its ecosystem

Open Gradient shares a month of progress since its $8.5m raise, including their devnet launch, SDK rollout, model hub introduction, and seed funding updates

Masafi joins forces with Moraq Gaming to drive prediction markets powered by AI agents, using real-time data sourced from X

PIN AI’s Hi PIN Telegram app reaches 100k users, evolving from a game into a personal AI assistant

Story Protocol launches Odyssey, its final testnet, with close to 100 partners building applications on the platform

Huge s/o to Teng for his weekly updates — well worth a follow to stay ahead

I am pulling together a spreadsheet tracker of AI protocols — to be shared in next week’s edition, so keep an eye out for that when it drops!

NFT Market Volume

NFT volume is up across all major blockchains:

Bitcoin Ordinals lead the charge this week — perhaps they’re returning as a leveraged bet on BTC?

Ethereum NFTs:

Four categories of Ethereum NFTs stand out this week for ROI:

Yuga Assets: Cryptopunks and BAYC as Ape Chain is still building

The pudgy ecosystem is experiencing some relief after a recent sell off — Abstract is around the corner, perfect timing for the launch of the Consumer Crypto Layer 2

Notable NFT Sales

Several $100k + NFT/Ordinal sales this week as

OMG Blue eyes continue to trade over 1.5 BTC as floors on Ordinals pump

Cryptopunk grails are accumulated — perhaps liquidity will flow back into non fungible tokens once profits have been made on the fungibles?

New Participant Indicators

Institutional/Regulatory Developments

Crypto Headwinds

(H/t Mando’s Minutes)

That’s a wrap for issue 98 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

And if you thought this was interesting, please consider subscribing to this Substack and following me on Twitter for more on NFTs and Web 3.0.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets mentioned in this newsletter.