The Agentic Future: Tokenized AI Equity & Private Robotics Market Access (11.25.25)

Tokenized equity arrives as Caesar launches US shares on-chain, DePIN revenues accelerate, and robotics evolves as we break it down on this week’s Supercycle podcast.

This Crypto AI newsletter consists of three parts:

Snippet Partner (XMAQUINA: Public access to Private Robotics Companies)

Market Overview

Emerging Developments

Enjoy the journey and if you have any questions feel free to reach out to me on X

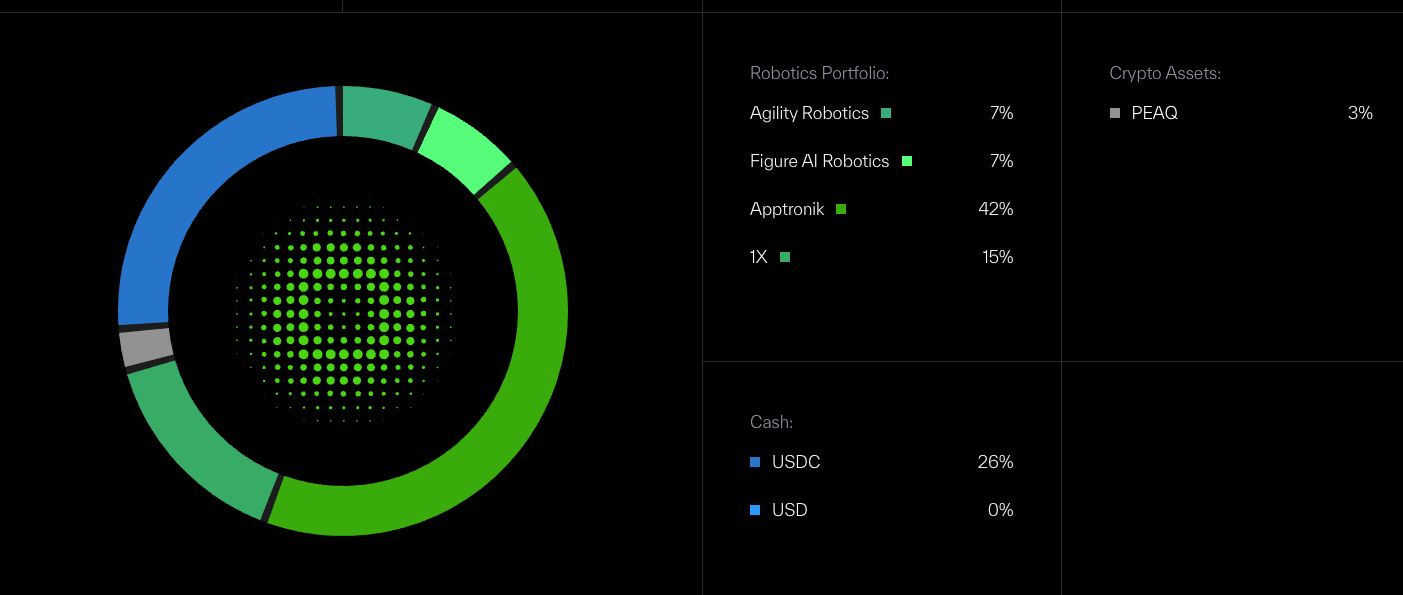

XMAQUINA is revolutionizing access to the $50B+ humanoid robotics market through their community-governed “Robotics Bank.”

With $31.9M treasury invested in firms like Figure AI, Agility, Apptronik and 1X Technologies, $DEUS holders gain exposure to previously VC-locked opportunities:

Final Pre-TGE Opportunity: Secure whitelist access for the final community Genesis Auction for $DEUS before public launch. Priority access ensures you don’t miss the final discounted entry point.

December 1st Launch: The DAO Contributor Leaderboard debuts - a revolutionary system blending mindshare tracking with builder/creator bounties. Earn $USDC and $DEUS rewards while unlocking governance privileges and exclusive DAO roles. Simply mention XMAQUINA or DEUS to start climbing ranks.

Secure Your Whitelist: xmaquina.io/community-genesis-auction

This newsletter goes out weekly to 6,907 subscribers.

Please don't hesitate to message me directly for sponsorship or partnership enquiries

AI Roundup

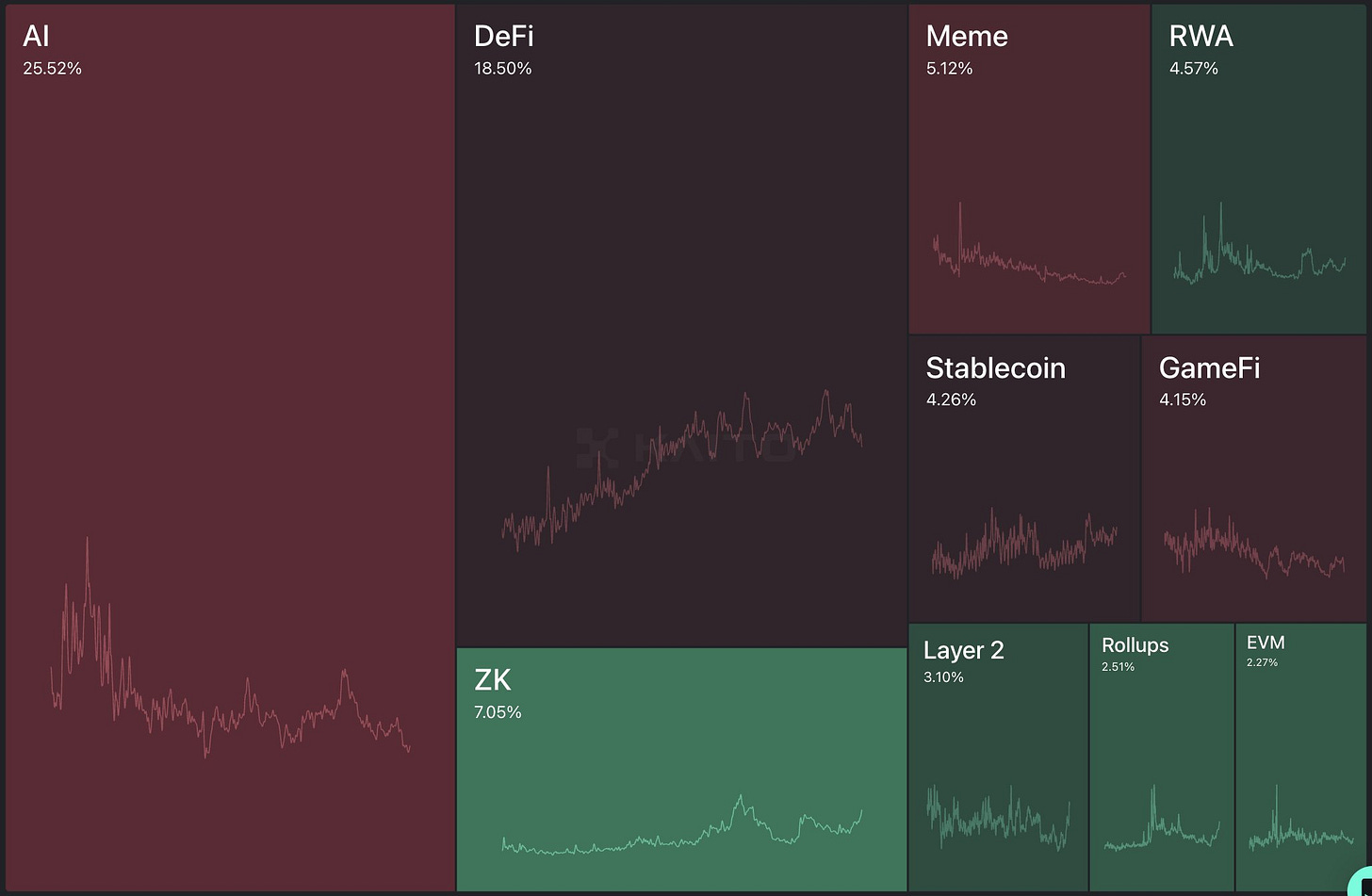

Decentralized AI (“DeAI”) ‘Crypto Twitter’ mindshare has dropped by 4% this week:

Robotics and X402 have also dropped out of the ‘top’ conversations on the timeline.

But this isn’t because innovation isn’t happening, it’s more likely being taken over by three other strong narratives:

Privacy (ZK): Aztec and Miden launch on Ethereum

EVM: Monad Mainnet went live this week; PrimsmAI is pegged to watch for the intersect of crypto and Robotics

Prediction Markets: Conversations around steady growth in portfolios higlight an alternative way your average retail user can make money outside of the traditional banking systems (provided they have an edge in a given market).

AI Prediction Market Indicator:

The “wisdom of crowds” (through prediction markets) suggests that the AI bubble is not likely to burst anytime soon:

96% of participants don’t think this will happen before December 31st, 2025 and 64% believe it won’t happen before the end of next year.

Google’s Gemini 3 launched this week and tops the benchmark tables

Grok hits 10m daily visits; their highest since its launch day

Average retail users are baking AI models into their daily workflows and it’s not slowing down or regressing in its performance.

So could we see another rally in DeAI + Robotics assets before then?

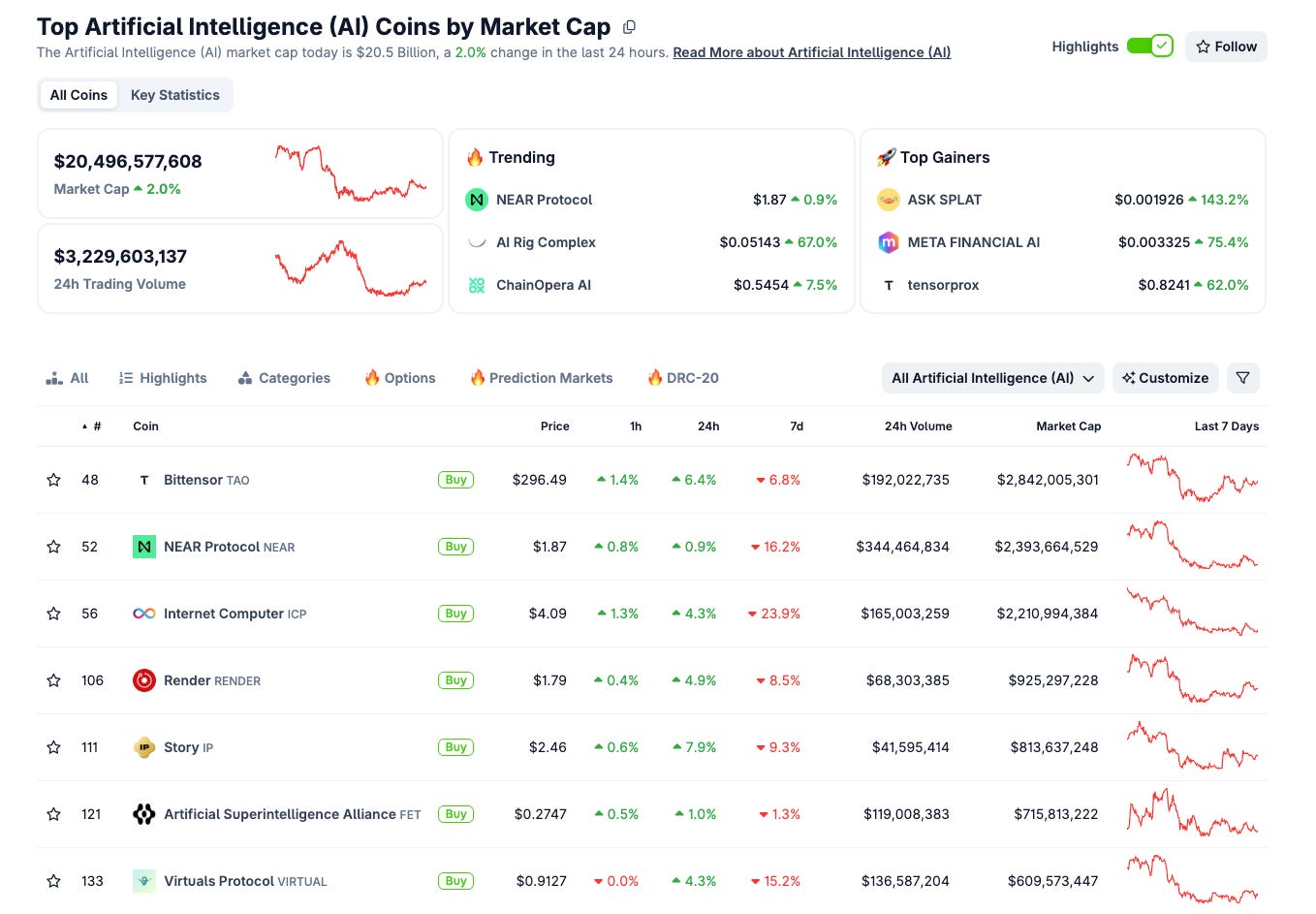

a) DeAI Market Cap

The overall DeAI market cap is down by $2bn (-9%) to $20.5bn:

The entire DeAI market continued to decline consistent with the broader market as Bitcoin bounced off $80k for the first time since April this year.

The Bittensor ecosystem held up the strongest with a dip of 7%, as more of its subnets find product market fit with the real world. It also saw 17 alpha token liquidity pools go live for trading on Base, using Chainlink’s infra.

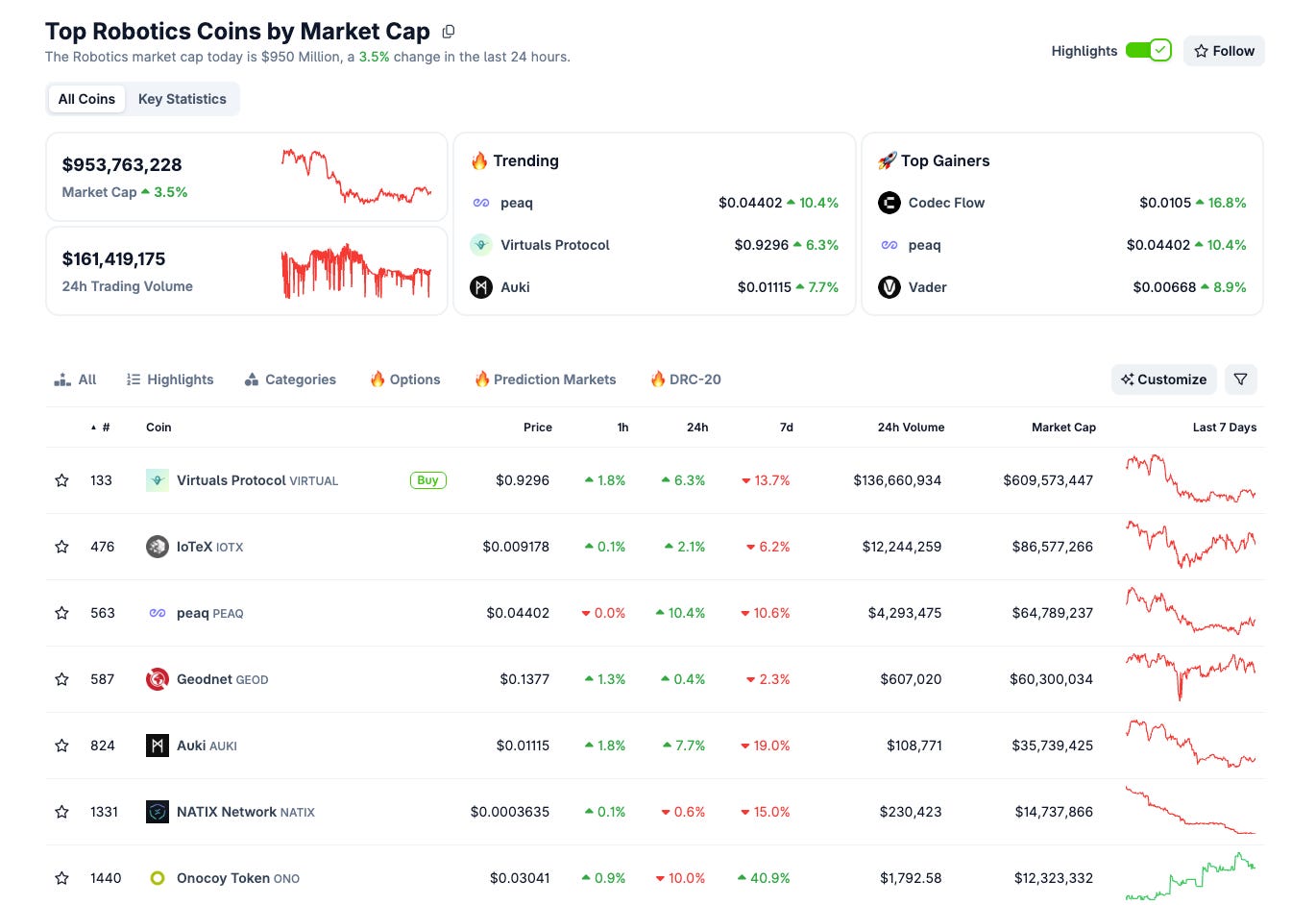

b) Robotics Market Cap

The Robotics market cap fell by $150m (-14%) to $950m this week:

Similarly the key driver is broader macro, but there are pockets of performance as those with real revenues sustained the downturn moreso than others:

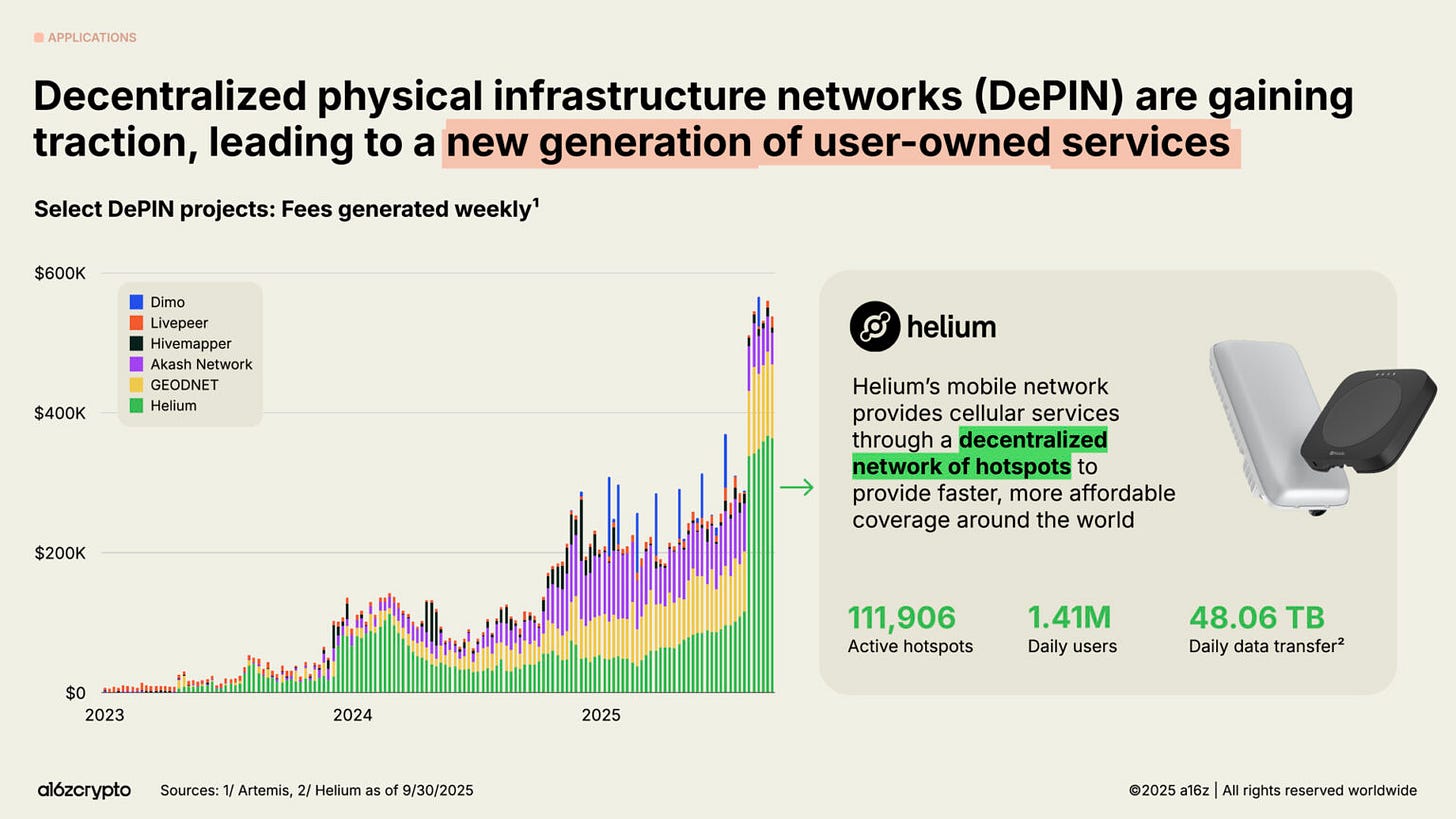

GEODNET was featured in a16z’s DePIN report highlighting strong growth in revenue.

Similarly to TAO on the broader DeAI segment, GEOD is finding real world product market fit with Geospatial mapping for the impending traditional robotics boom.

Where’s this all heading?

I hosted this week’s Robotics episode of the Supercycle podcast with Auki and Bitrobot provided some great insights: Link

2. Crypto AI Agent Analysis

a) Nansen Smart Capital Flow Analysis

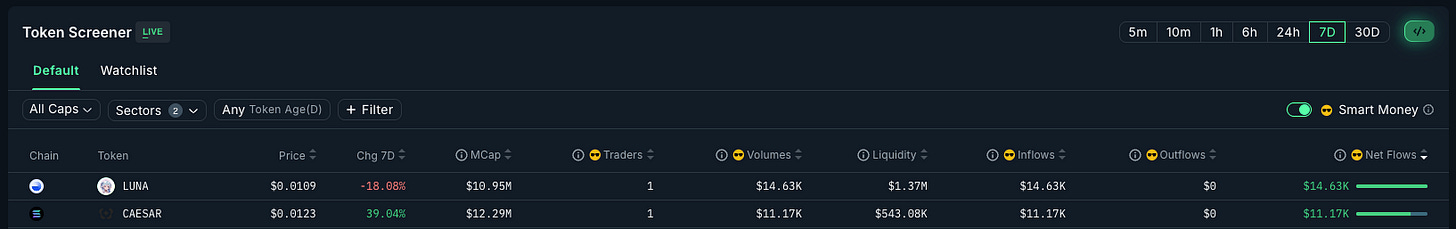

Capital net flows have resurfaced some familiar projects in Ai16z + Alch this week:

Caesar announced its issuance of tokenized US Equity, being a first to tokenize a US (formerly British) AI Lab’s equity and the market responded positively:

Luna is the flagship agent for Virtuals, which is getting more traction again recently following increased agentic activity amongst its Agent Commerce Protocol (“ACP”); Its Luna.Fun launched two weeks back for AI Generated Content platform.

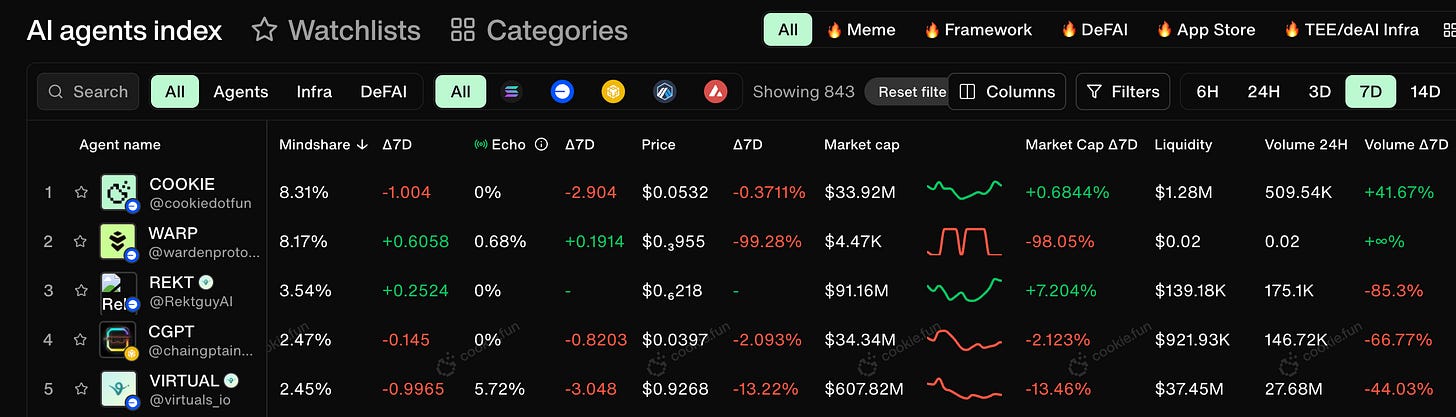

b) Cookie Mindshare Analysis

No major changes from the protocols from last week, but note that REKT has recovered somewhat following the liquidations events mentioned last week.

3. AI Agents Developments: Innovations and Market Developments

Here are some other interesting Crypto AI related developments this week:

News this week includes:

monad mainnet goes live today with PrismaXai pegged as the AI/Robotics company to watch on day 1. h/t: jinglingcookies

gtaoventures unveiled a non-custodial liquid staking protocol bridging 17 Bittensor subnet alpha tokens to Base using Chainlink‘s CCIP

Qualigen rebranded to AIxCrypto Holdings (Nasdaq: AIXC), unveiling a “Three Driving Forces” strategy: BesTrade DeAI Agent ecosystem, RWA + EAI development including $5M FFAI tokenized shares

PRXVTai‘s (virtuals_io eco) px402 privacy-preserving payments go live with px402-OTF and the team sponsoring up to 1 million free x402 transactions

The Agentic FoF by BasisOS for Virtuals’ “Agent Commerce Protocol” (ACP) has been compromised due to a security breach, exposing approx $531k. ethermage

has assured that any losses will be made whole by the Virtual’s treasury

MessariCrypto highlights SpexiGeospatial as 512 new “Spexigons” (mapped areas) are added to its spatial mapping; this mapping provide the geospatial awareness for robotics + more

xmaquina (Robotics investment vehicle) announces its DAO Contributor Leaderboard, which is set to launch on Dec 1. “A custom layer that blends mindshare, builder, and creator bounties” as the $DEUS token comes closer to going live

[ACTION REQUIRED]: If you placed on the vooi_io AI powered DEX aggregator cookiedotfun campaign, make sure you “Apply to claim” to be eligible to claim the airdrop. It requires X, TG + wallet info to be linked before Thursday.

silencioNetwork (Robotics Audio infra) removes another $4k of SLC from circulation through the Alpha Burn Program; it may seem trivial but this demonstrates an intent to align revenue + tokenholders; we’ve seen other DePAI entities like GEODNET (GeoSpatial) show similar commitments with their 80% buyback and burn, backed by QoQ revenue growth

sire_agent alpha vault continues to outperform with +$20k PnL (+9.5%); Sire is an agentic oddsmaker powered by TAOs Subnet 44 (Vision)

flock_io produced its 2025 Earnings report with 11.9M Flock in fee revenue ($2.7M as at 10/31), 784k validation + 9k training model submissions. Strong partnerships with Alibaba_Qwen and its AI prediction agent hits Top 6 on FutureX, outperforming proprietary solutions such as ChatGPT-Agent, Grok-4

peaq infoFi rewards are live for this month; the amounts are vested over 12 weeks so check your eligibility

ACO_labs parters with R3ACHNTWRK to bolster visual content capabilities using its AI tooling; i’ll link the trailer below

That’s a wrap for issue 152 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

If you found this interesting, please consider subscribing to this Substack and following me on X for more related insights.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets and have partnerships with some of the projects mentioned in this newsletter.