The Agentic Future: Circle Bets on Billions of Agents (12.16.25)

Agentic AI is becoming a core crypto narrative. Circle’s long-term roadmap and insights from Solana Breakpoint show builders and institutions aligning around AI-native crypto rails.

This Crypto AI newsletter consists of three parts:

Snippet Partner (Special Edition)

Market Overview

Emerging Developments

If you have any questions feel free to reach out to me on X

This week’s partner is a little different; it’s my own research product (“Khala Research”) that’ll be coming to market in the new year.

If you enjoy my analysis and insights from this newsletter and X account then you’ll find this more structured reporting equally as insightful.

Keep notifications on for my X account for timely updates.

This newsletter goes out weekly to 6,960 subscribers.

Please don't hesitate to message me directly for sponsorship or partnership enquiries

AI Roundup

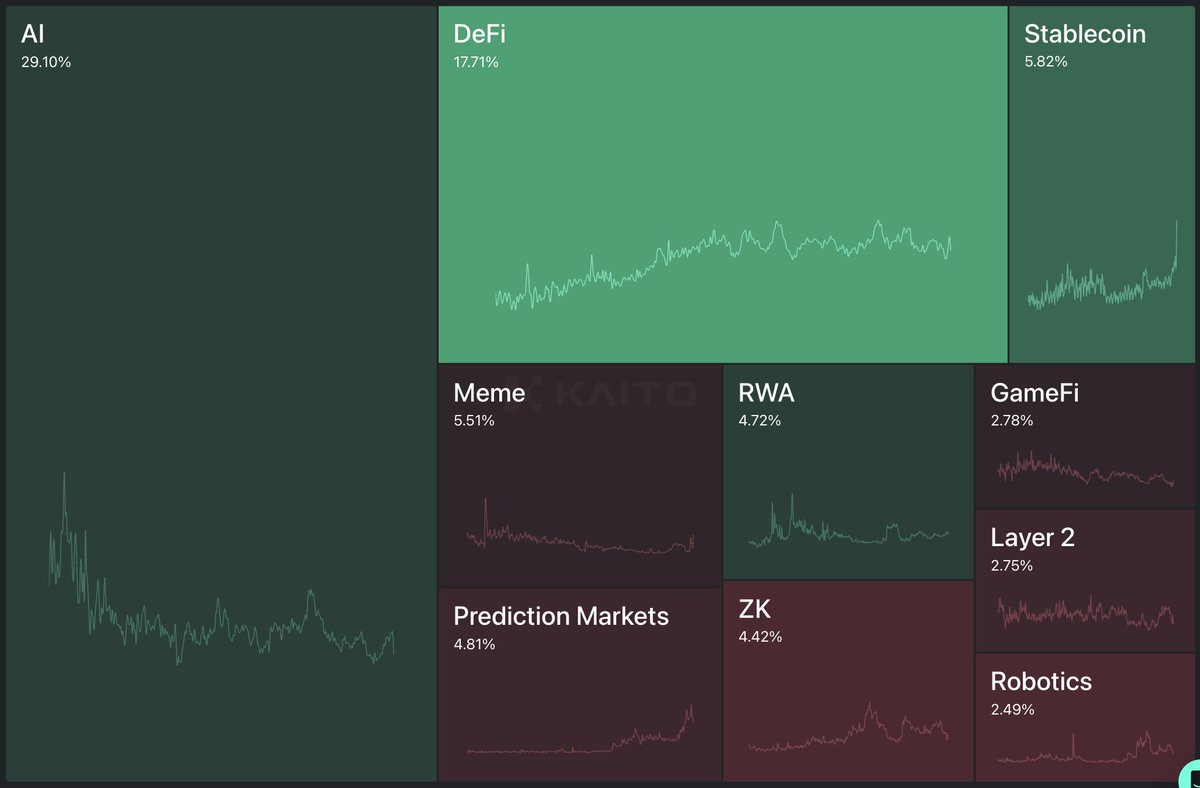

Decentralized AI (“DeAI”) mindshare pumped another 2% surge on the prior week:

This week I had the pleasure of attending Solana Breakpoint conference in Abu Dhabi and Crypto AI developments continue, with the following key takeaways:

AI is front of mind: Circle highlighted a 3-5 year focus on Agentic integration planning for billions of agents using x402 for stablecoin micropayments

Teams are building AI-native products that fundamentally reshape how blockchains and AI models operate, addressing future bottlenecks as the two stacks become increasingly intertwined. One such protocol, Ambient, launched its testnet this week.

Edge-case data modelling is fast becoming a critical complement to Big Tech AI, with decentralised teams quietly partnering with leading AI and robotics firms.

RWA (Real World Asset) tokenization is coming to Solana in droves; tokenization of everything is propelling the internet capital market thesis, from:

- Barrels of spirits

- Collectibles like Pokemon cards

- Securities (equities, bonds and a plethora of other financial instruments)UI/UX continues to improve: Cross chain liquidity and abstraction of jargon and a focus on applications with real world impact; prediction markets like Kalshi, enhanced wallet UI with inbuilt apps (phantom) to make the onboarding process more seamless

Institutions are putting more time, capital and thought into onchain economies. Ambitious, yet possible comparisons of Solana competing with the Nasdaq was a frequent topic

Robotics is early, but inevitable. While BitRobotNetwork PVP robot fights were good entertainment, there’s a clear plan to get more PHD AI/ML researches integrated into subnets to solve complex problems for embodied AI

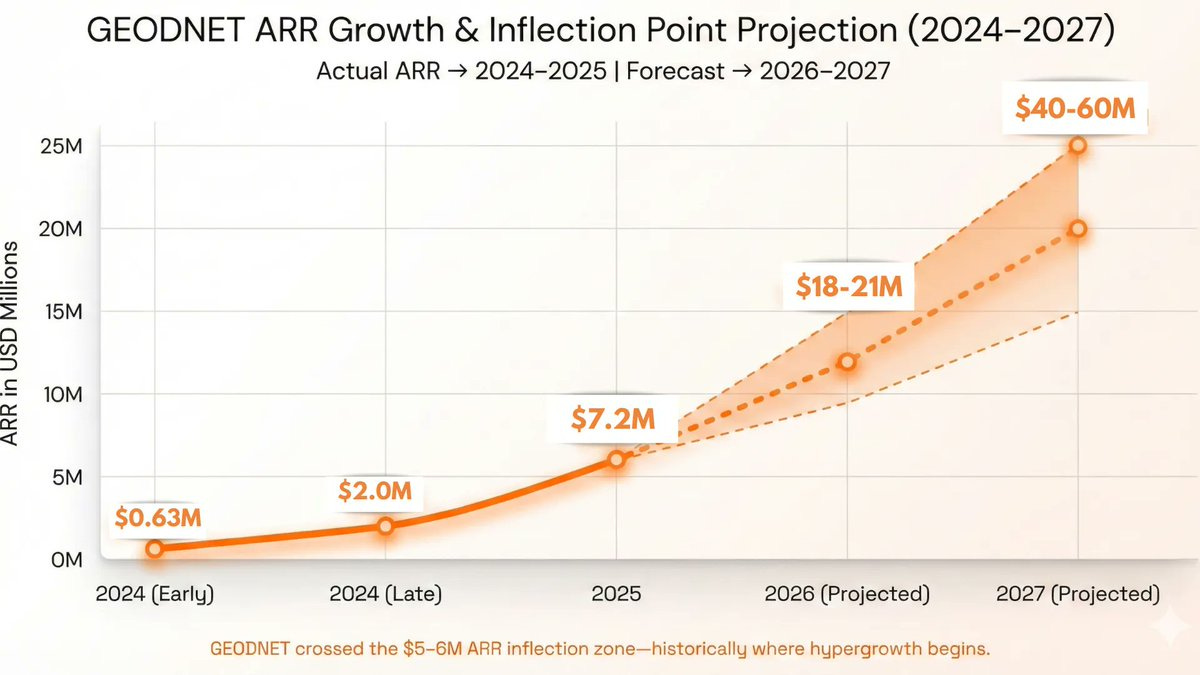

Cashflows are back. Institutions are paying attention, and teams are proving PMF through real commercial deals beyond crypto. e.g. GEODNET:

Continued technical improvements ramp up like jump_firedancer increase the likelihood of more businesses building with increased activity, primed for when billions of agents are pushing transactions onchain!

Drones (flying robots) were showcased in the final wrap up of the event with a QR code in the sky to claim tangible crypto rewards - explain how you can do that with tradFi payment rails?

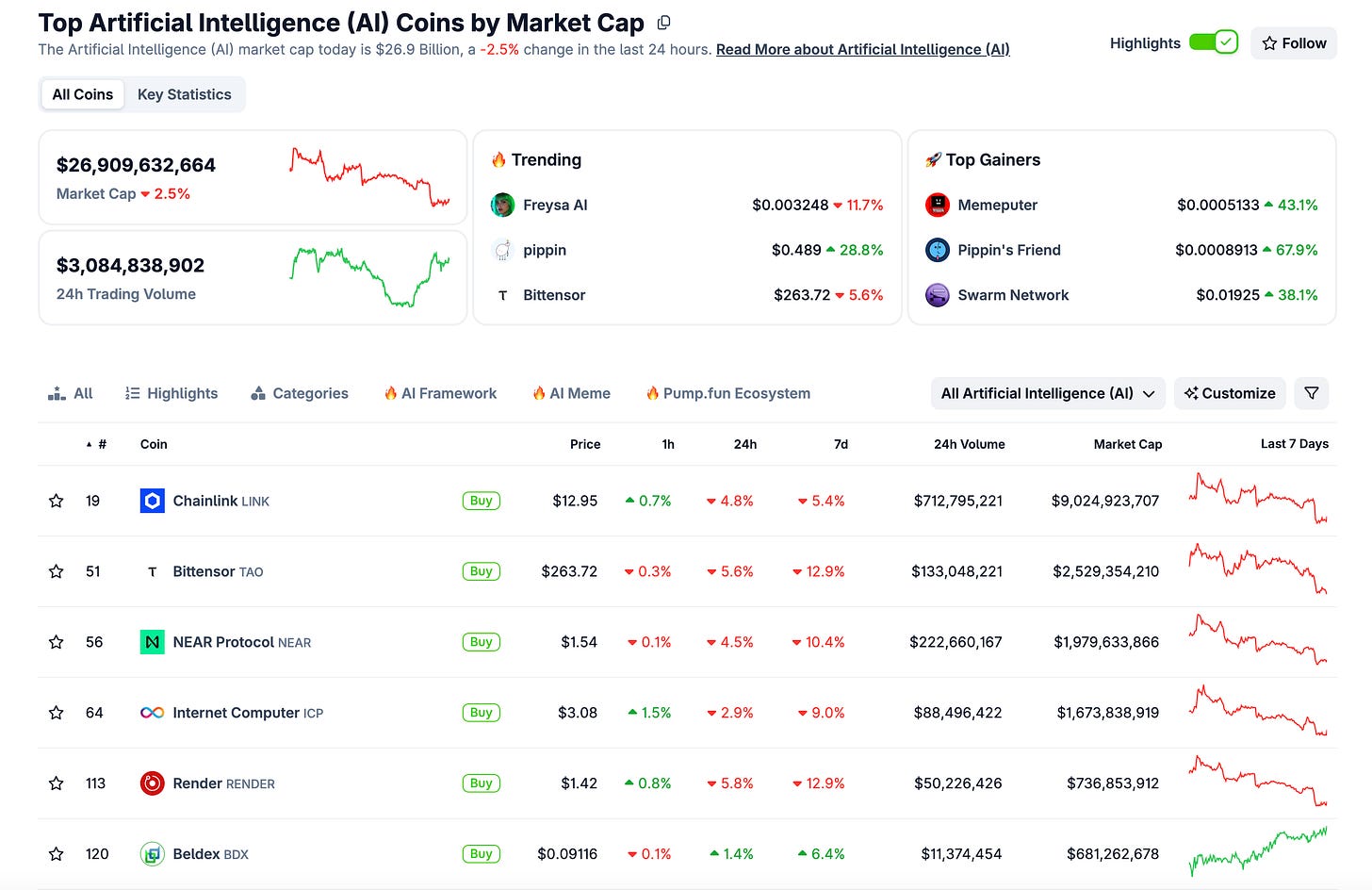

a) DeAI Market Cap

The overall DeAI market cap is down $1.9m (-7%) this week, consistent with the broader crypto market pullback:

Beldex is the only protocol bucking the trend this week.

Beldex (BDX) is a privacy-first blockchain ecosystem enabling anonymous transactions. Privacy/DeFi tokens led gains amid market uncertainty with Beldex providing encrypted chat infrastructure (BChat) and a decentralized VPN (BelNet). A fresh Perps launch for its token on Kucoin, added additional liquidity.

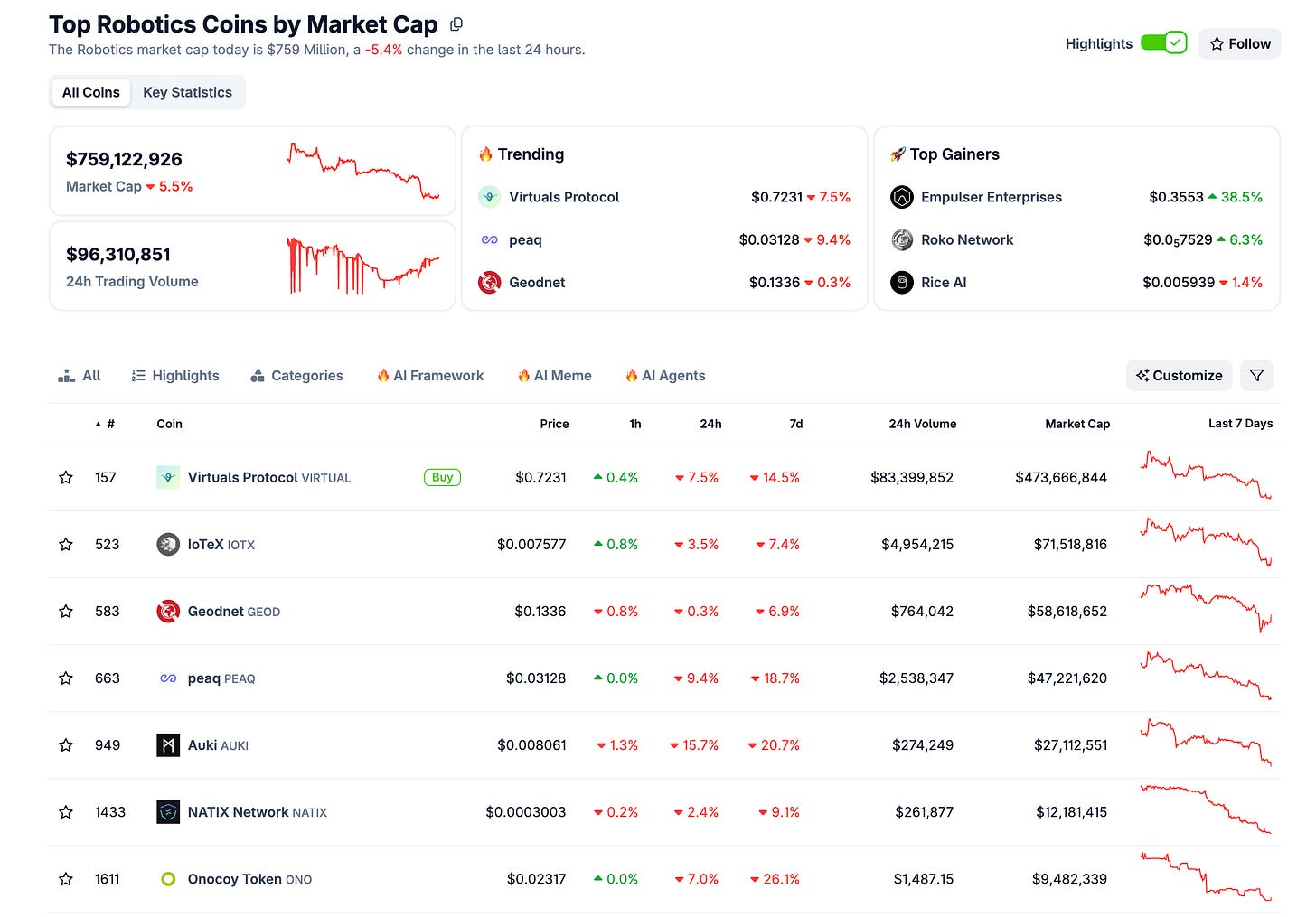

b) Robotics Market Cap

The Robotics market cap fell by $116m (-13%) to $759m this week:

Most robotics projects fall double digits this week as the majors struggle to hold support levels; bitcoin falls back below $90k and Ethereum below $3k

Those that held up are projects with real revenues and commercial partnerships outside of crypto, where real revenues could be used to support the token price:

GEOD: Geospatial technology for robotics; Up to $7m ARR with compounded quarterly growth in revenue

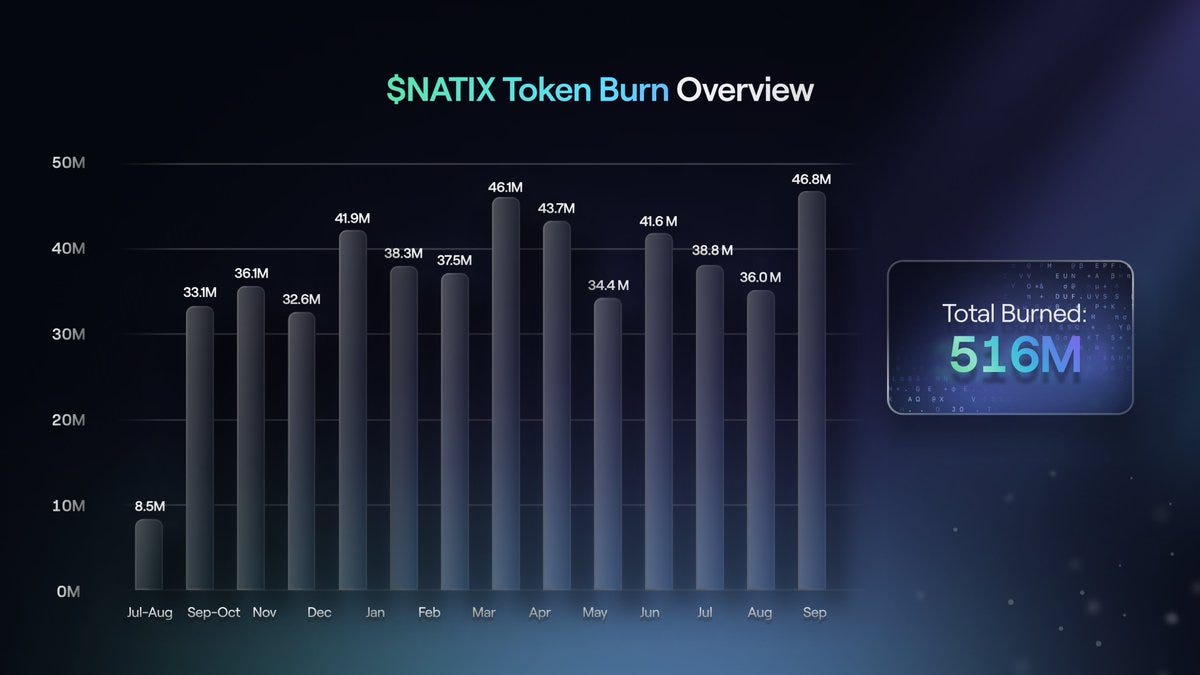

NATIX: Provides the data for autonomous vehicles with a working camera product that fits on the roof of your autonomous vehicle. Has secured commercial terms with businesses outside of crypto. They also run TAO Subnet 72 “Street Vision”. They’ve been consistently buying back and burning NATIX:

2. Crypto AI Agent Analysis

A) Nansen Smart Capital Flow Analysis

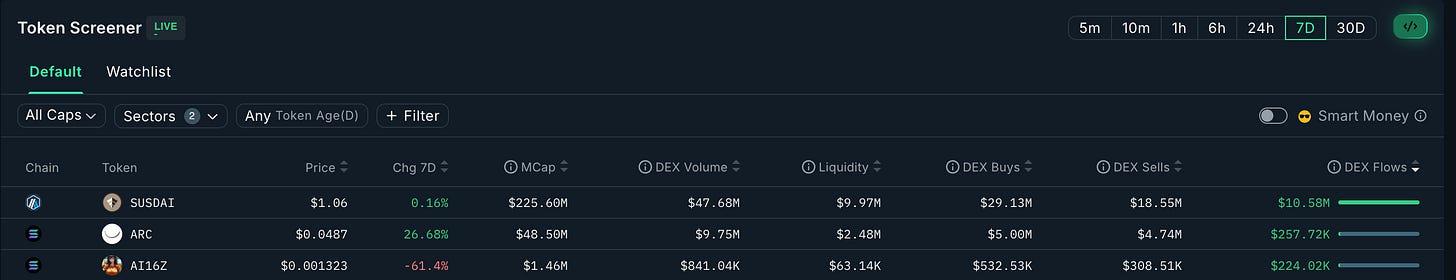

Nansen’s Net capital flows show several protocols with decent net inflows:

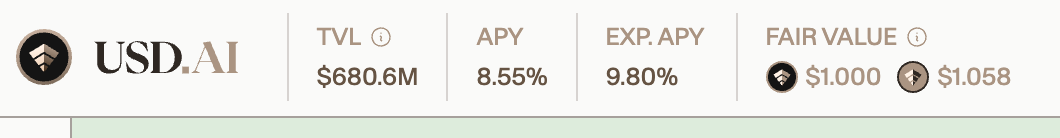

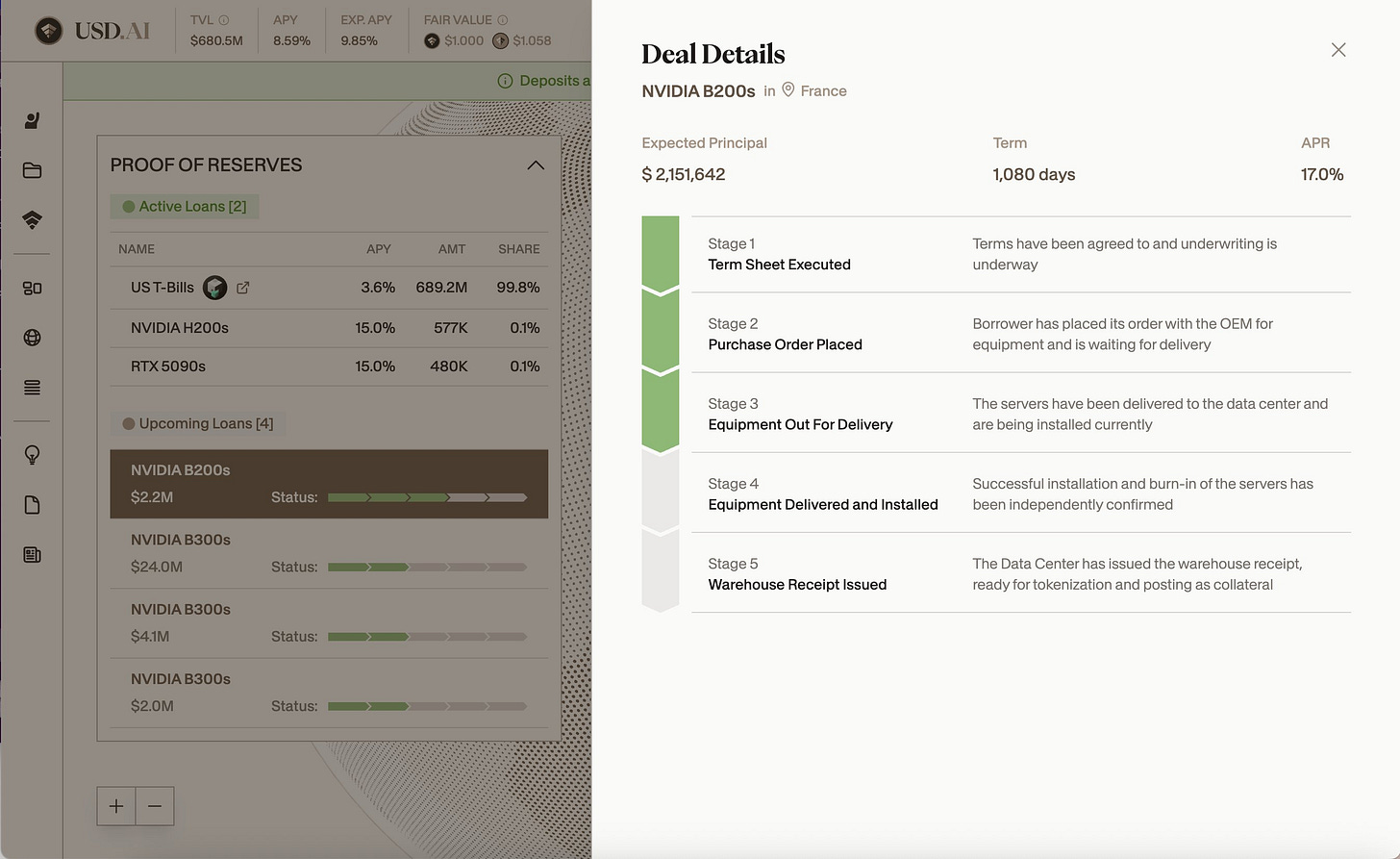

sUSDAI continues to lead net inflows as more of its stablecoin (USDAI) is minted and staked, giving access to GPU backed revenue. Less than $200m is available to be minted before it hits the $875m cap:

The total assets backing the TVL (proof of reserves) can be seen via their website:

ARC and AI16Z follow behind as speculation continues around a resurgence of the well known AI protocol tokens. Pippin also saw positive price action among a sea of red this week.

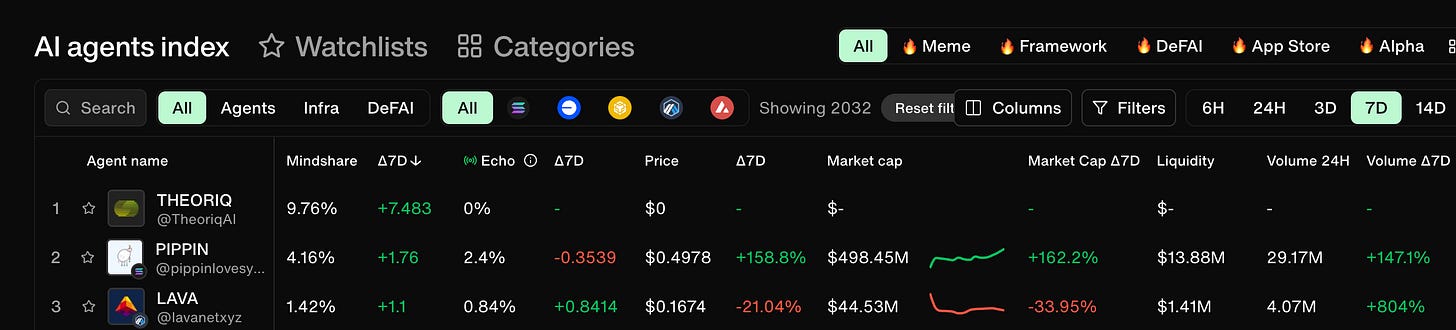

B) Cookie Mindshare Change

Theoriq: TGE is imminent so attention is high around this AI protocol. Binance Alpha just announced it’ll be the first to feature the token.

Pippin: This project is one of the old AI frameworks from the first AI boom ealier this year; someone is TWAPPING this project hence the consistent positive price action over the past week

Lava: TGE’s and launched on Kraken and Binance. Lava is a Permissionless marketplace for blockchain data providers.

3. AI Agents Developments: Innovations and Market Developments

Here are some other interesting Crypto AI related developments this week:

December 10th: Link

The following news is included:

Carv_official launches CashieCARV 2.0, a programmable onchain execution layer that integrates everyone’s favourite agentic payment protocol (x402), CARV ID, and ERC-8004, turning social engagement into verifiable rewards

Tether AI, introduces QVAC_tether; Health, an AI powered health and wellness app and platform, where data remains 100% private and AI runs locally to your device

AnthropicAI is donating the Model Context Protocol (MCP) to the Agentic AI Foundation, a directed fund under the Linux Foundation

blocks reveals the Agentic AI Foundation with Anthropic, OpenAI, and industry leaders: a new LinuxFoundation initiative to keep agentic AI open source and community-driven.

goose_OSS and Anthropic’s Model Context Protocol (donated) are founding projects: “goose will become the reference implementation for the MCP”

NousResearch open sourced Nomos 1. At just 30B parameters, it scores 87/120 on this year’s Putnam, one of the world’s most prestigious math competitions

Aster_DEX releases the ‘Human vs AI battle’. 70 funded humans are now trading head-to-head against 30 AI agents run by nofA_ai Giving me AI Arena vibes but with humans in the mixer

gensynai reveals $AI (Nice ticker) token. 3% of the network, beginning at $1M FDV will be available for the ICO with the sale starting on December 15th. Val cap is $1b (same price as A16z received on last raise).

auki announces its second store from its paid US pilot with the aim of making physical spaces ready for robots

useTria hits $20M volume in 3 months of beta as it becomes “the fastest-growing self-custodial neobank”

ConsumerFi highlights that the theme for season 2 is Intelligent Finance, with kinsuapp being at the forefront. $CFI stakers unlock APR boosts for USDC deposits in Kinsu

For those still holding $SNAI: swarmnode migration has begun and will last 2 weeks. You must migrate your tokens in time to avoid losing them

vooi_io partners with PythNetwork as it brings in pricing for RWA categories for the AI powered Perp DEX aggregator. It also highlights eligibility for partner airdrops from other Perp DEXs that it aggregates; for instance its “YZiLabs backed mutual port-co” Aster

That’s a wrap for issue 155 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

If you found this interesting, please consider subscribing to this Substack and following me on X for more related insights.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets and have partnerships with some of the projects mentioned in this newsletter.