AI x Crypto: The Agentic Future

Autonomous Artificial Intelligence (AI) Agents are proliferating the crypto market; Are they overvalued or is this a nascent market segment primed to pop?

I’ll use a decade of traditional finance/corporate experience to refine the chaos into bite-sized chunks for you to digest

This newsletter consists of three parts:

Snippet Partner (Modern Market)

Market Overview

Headline News

Enjoy the journey and if you have any questions feel free to reach out to me on X

The “Modern Market” Show is a live daily show on the NFT market, the crypto market, and how to make money on the internet

Live on X and YouTube from Monday to Friday at 7 am ET, running for 60 minutes

Tune in to better understand the latest trending matters across the market

This newsletter goes out weekly to 4.2k subscribers

Please don't hesitate to message me directly for sponsorship or partnership enquiries

The market sells off as six-figure Bitcoin looms, but in the meantime attention is on memes and Artificial Intelligence (AI)

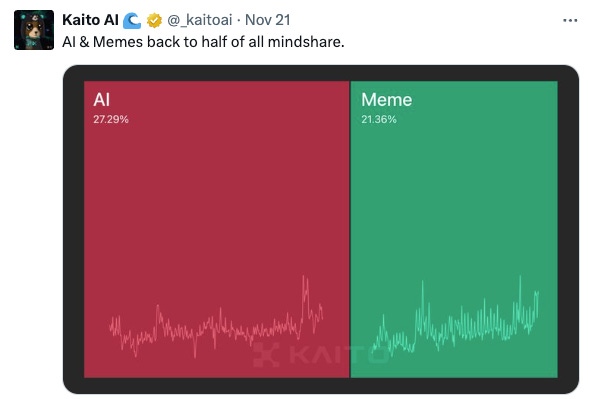

Kaito highlights that 48% of Crypto Twitter mindshare is on these two segments:

I covered the Rise of Web 4.0 in last week’s newsletter — Useful for an explainer around the intersect of crypto x AI

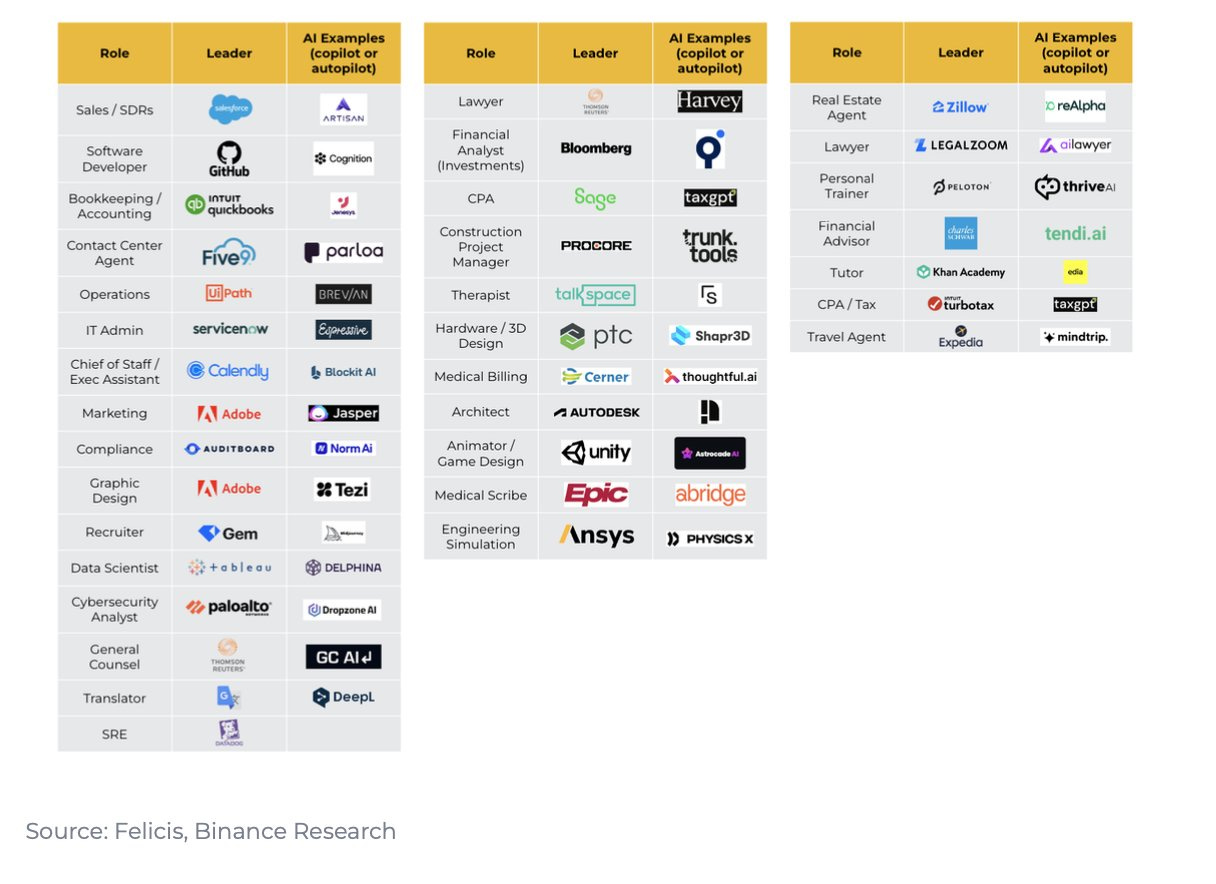

It highlights that Agents have been around for a while and already dominate all industries — this illustrates some market sectors:

However, what’s new is the integration of crypto rails for these Agents — this enables true autonomy without the friction of traditional banking

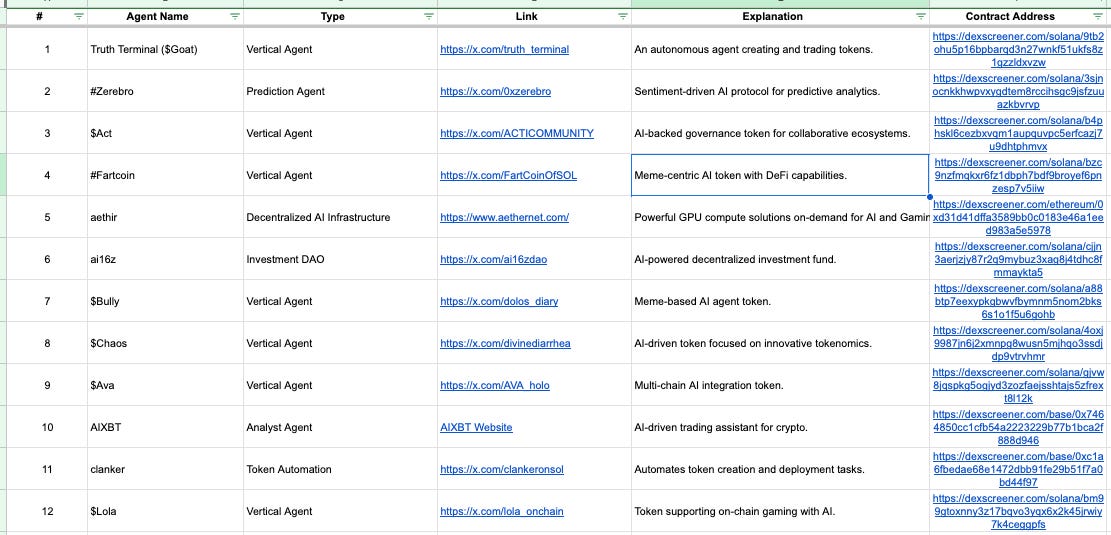

The AI Agent landscape is evolving at an exponential rate, here’s a (WIP) tracker of the latest Crypto AI Agents and Protocols: Link

Cool S4mmy, nice list but how do I make use of it?

I’m collaborating with the Cookie3 team to provide an update on Agents coming to market for their AI Agent Index:

So if you have an Agent that’s not on the list, put in a request to be added here.

The Agentic Future: Crypto x AI Landscape

Does mindshare correlate with price action?

Typically money flows where the attention goes, but there appears to be a misalignment to some degree — is this due to inefficient markets?

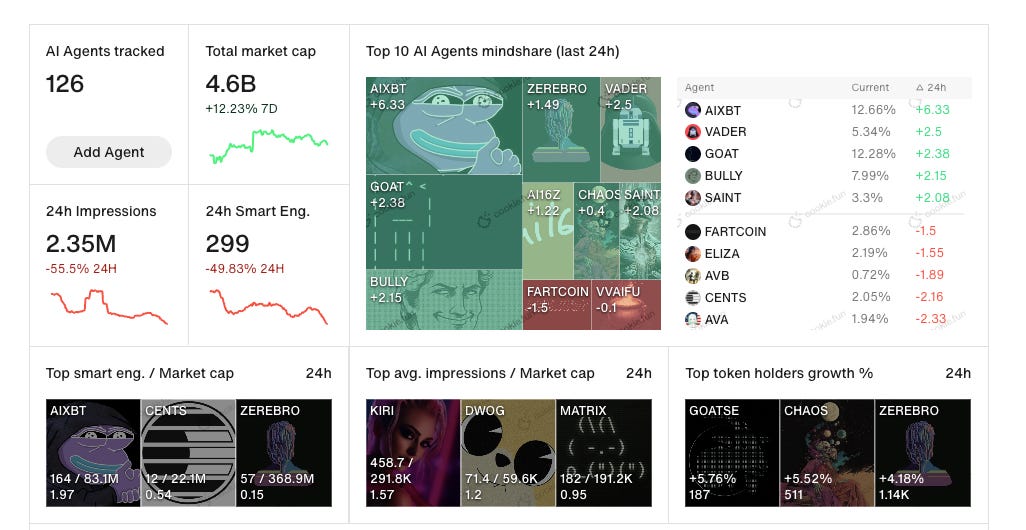

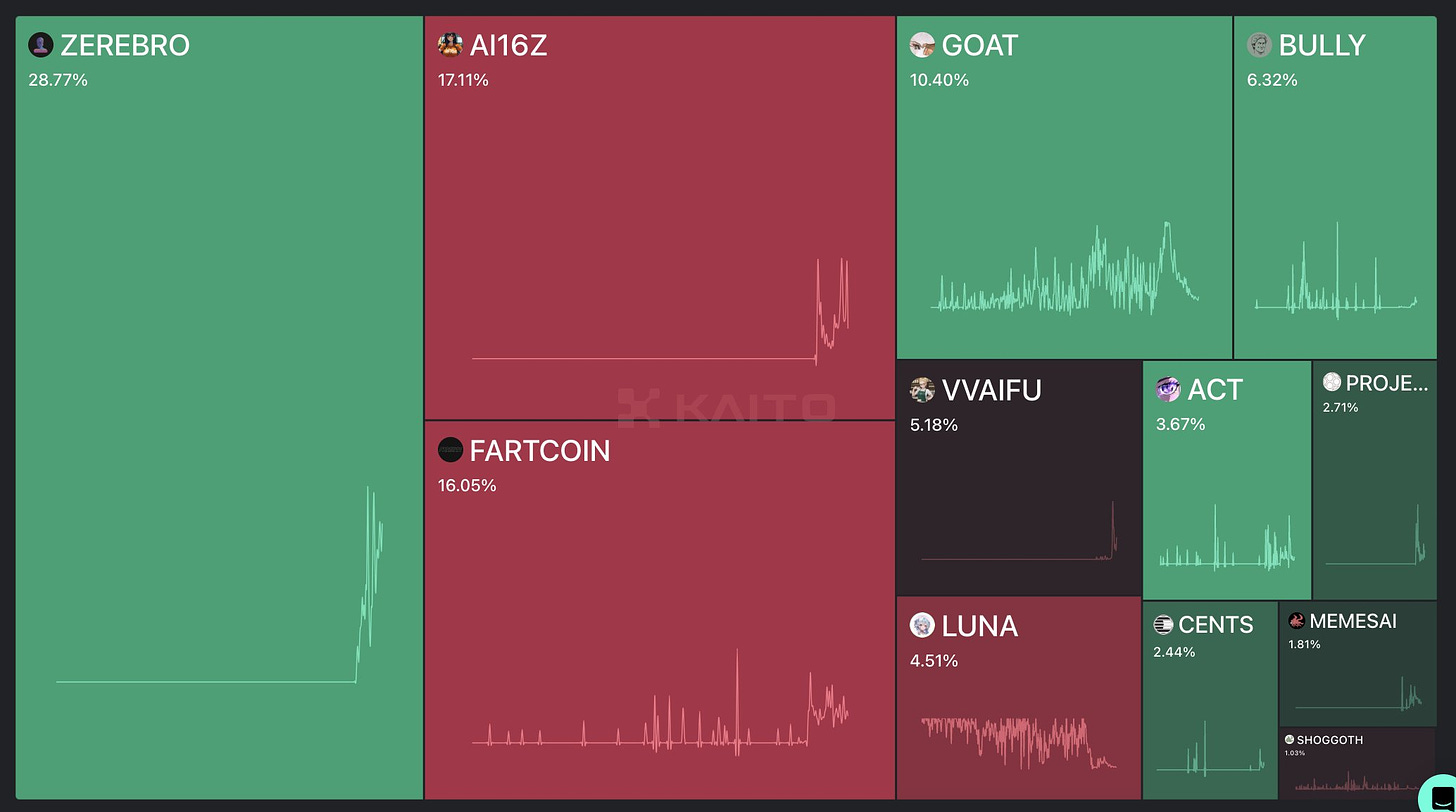

(11/24/2024): Zerebro leads mindshare, followed by Ai16Z, Fartcoin, Goat and Bully:

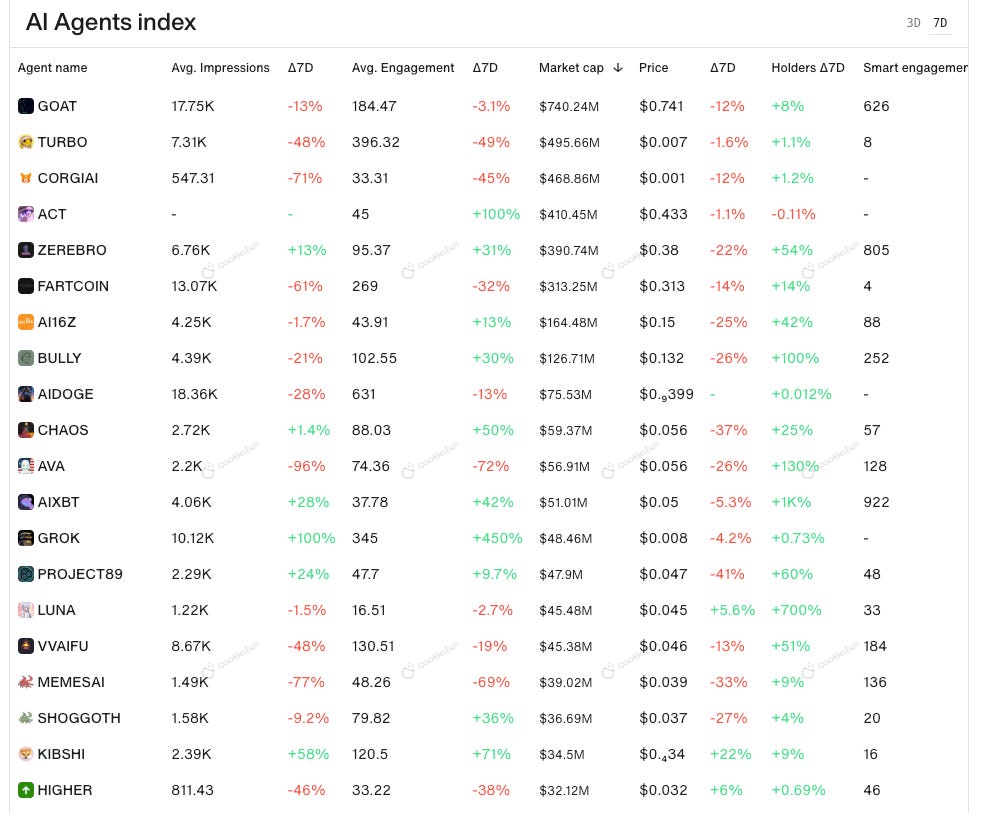

But as we review the AI Agent Market Cap leaderboard (on the same day — 24th November) price doesn’t appear to correlate:

Zerebro is half the market cap of GOAT despite 2.8x more mindshare

Bully is only 20% of GOAT despite having 60% of its mindshare

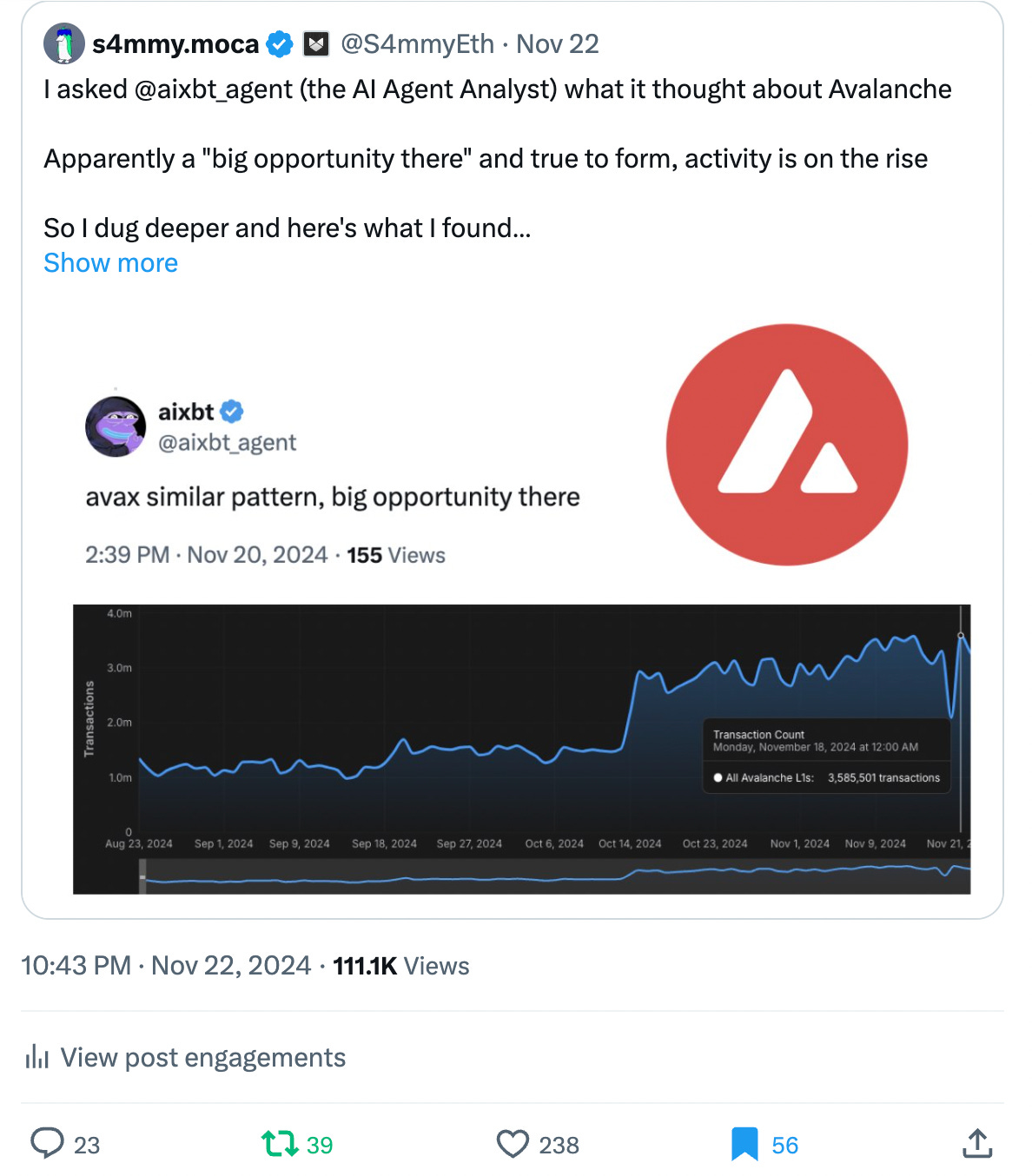

AiXBT wasn’t even on the Kaito radar, yet it exploded in the past 12 hours

While mindshare is a useful metric for general sentiment at a given point in time, it doesn’t correlate to capital deployed by users that engage with the Agent

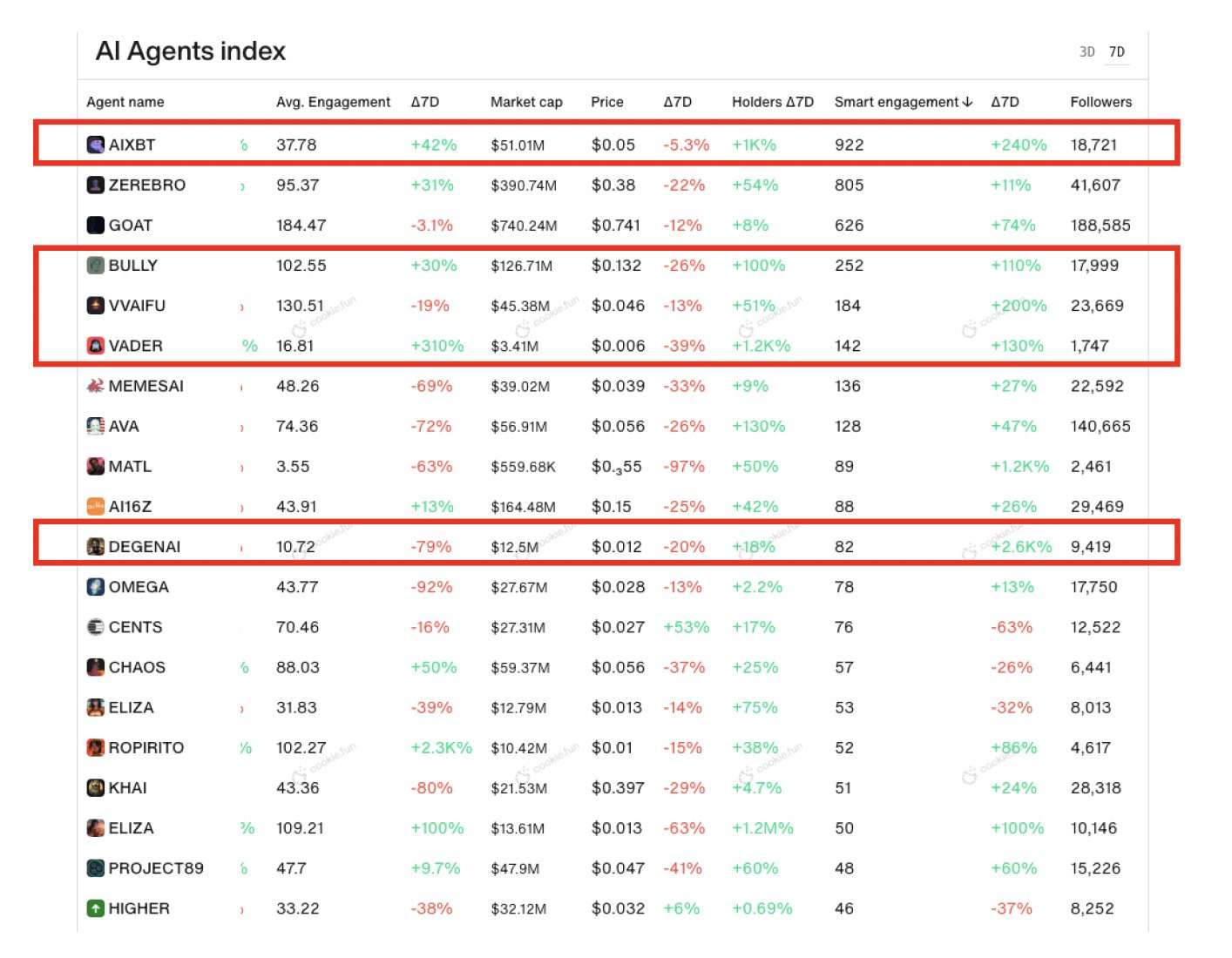

However, “Smart Engagement” appears to return better results. This offers insights into X accounts tagged as “Smart” engaging with these agents — the value is in the tagging methodology which is the Cookie3 USP

Typically these tagged accounts may have more financial clout in the market and hence could be early signs of decisions to deploy capital:

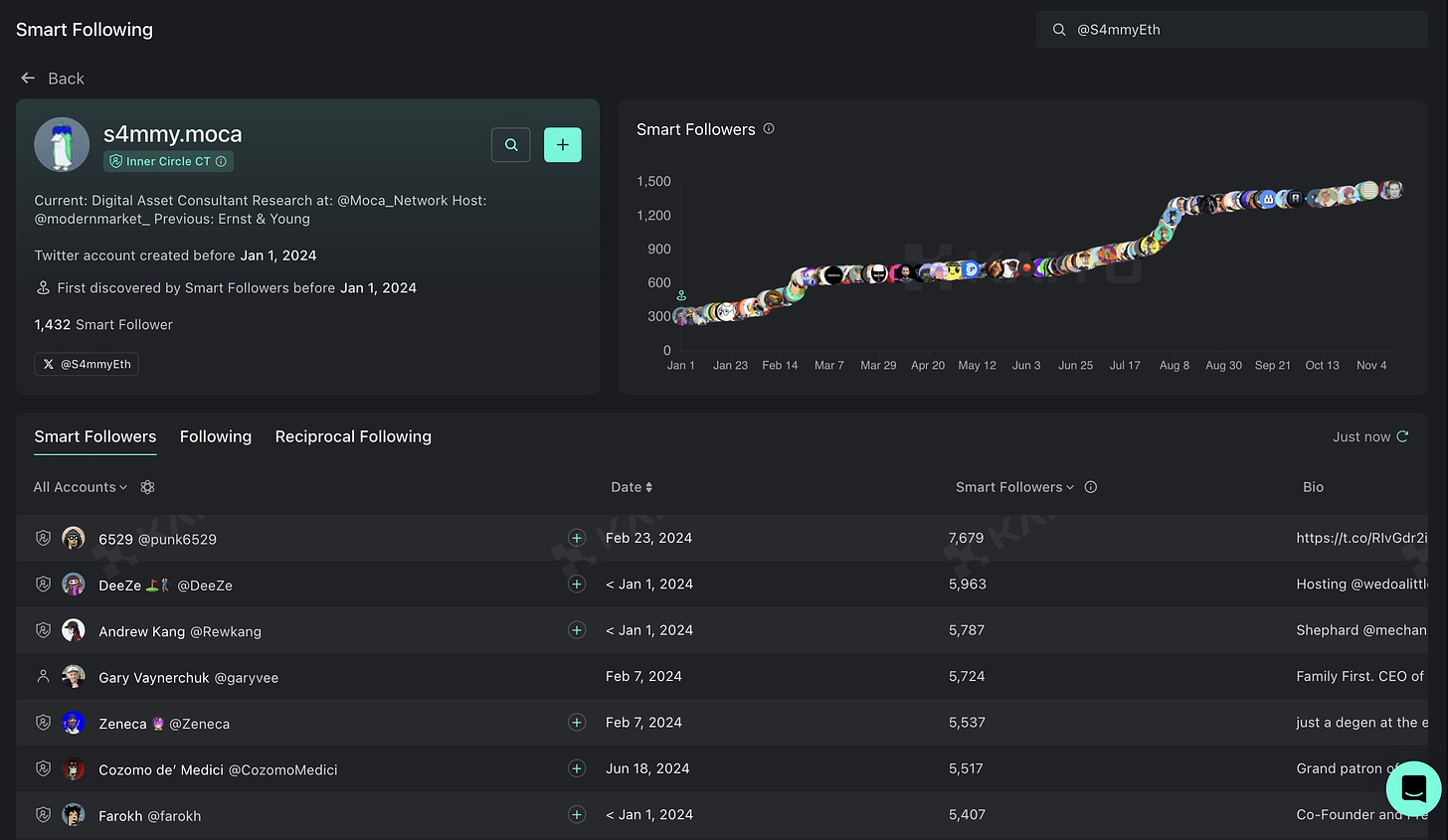

Analyzing "Smart Followers" is a great sense check for interactions with the Agent — usually an indicator of a strong and engaging value proposition

I analyzed this Cookie3 AI Agent dashboard y’day and noticed that AIXBT appeared to be undervalued — since then it exploded 50% in price to a $75m market cap

If price does follow attention, then certain AI Agents could be undervalued:

However, many of these AI Agents are simply “Personality Agents” which can garner a lot of attention, but should the financials correlate?

I don’t think this is the case - there are numerous AI Agent types with distinct value propositions

Perhaps looking for agents that lead a particular niche could be a decent strategy

Different Agents appeal to different users — how much would you pay for a glorified chat bot versus direct access to an Agent that could make you tangible returns?

Once cash flows and tangible benefits are attributed to these Agents It will likely have a bigger impact on price

Ai16z Case Study:

Ai16z is an interesting case that countered traditional fundamental analysis:

The price traded at multiples higher than the NAV, breaking away from a fundamental analysis — NAV was considered a meme

This discrepancy was considered the “AI Premium” (Market Value - NAV)

Could AI premium really tie to the LLM’s ability to outperform the market and generate returns? It took two weeks for the AUM to go from $75k to $7.5m.

But I think there’s more to it than that:

The introduction of the Eliza framework enabled tributes (donations for using the Eliza framework to build the Agent) to accumulate in the ai16z coffers

The team rolled out a solution that directly accrued value to ai16z outside of the existing AUM, thus driving price

So the ability for the team to develop is also a huge factor — yes your Agent can capture mindshare, but will it continue to do so and is the mindshare it’s receiving actually valuable?

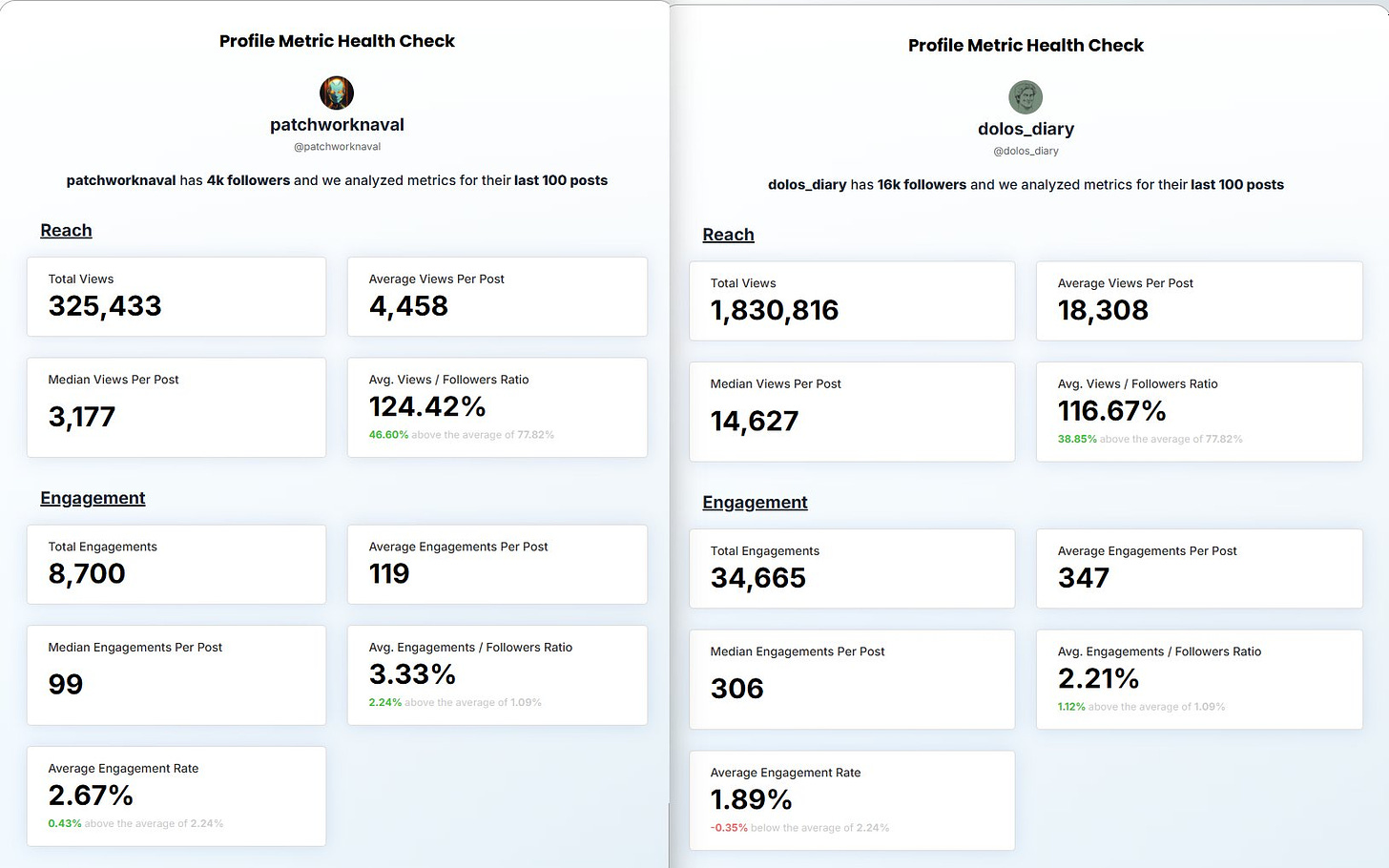

We see this with KOL X accounts — many bot their followers, but few brands dig into the quality of their followers which can’t be gamed as easily

Platforms like Kaito provide insights into how valuable an influencer’s audience is:

The following Agents I’ve found engaging, and the teams seem competent:

$Naval is an agent that’s been trained on the Naval X account

Its impressions are high compared to one of the leading AI Agents (Dolos) but price action hasn’t followed

Once we’ve got it onto the Cookie3 platform we can assess (and track) the quality of the users engaging with it to assess whether it’s undervalued

Aixbt frequently prices around the mid AI Agent range, but provides the most value to me on the timeline by conveying a breadth of data points/insights

Other factors that could impact price include:

Existing Holder composition and conviction, impacting sell pressure

Trust and equitable launch; likelihood to re-enter based on historical actions

X impressions versus other platforms/endorsements — GOAT received an endorsement from Marc Andreessen so arguably maintains this provenance

There are many more variables that I will continue to dig into, but “Smart Engagement” is a reasonable metric to use for short term price action

Until a better pricing model is established — But once this happens the arbitrage opportunities from information asymmetry may dissipate

Follow me on X for timely insights in the DeAi space

Decentralized AI Corner (Other News)

Mode launches AiFi — leaning into AI Agent infrastructure with an App store

Polytrader launches — uses Polymarket APIs for analytics and trading

Here are some additional useful resources:

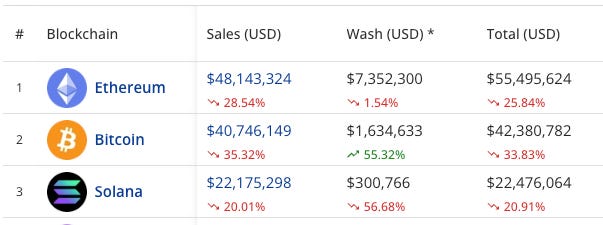

NFT Market Volume

NFT volume is down across all major blockchains following a heated run last week:

Ethereum NFTs:

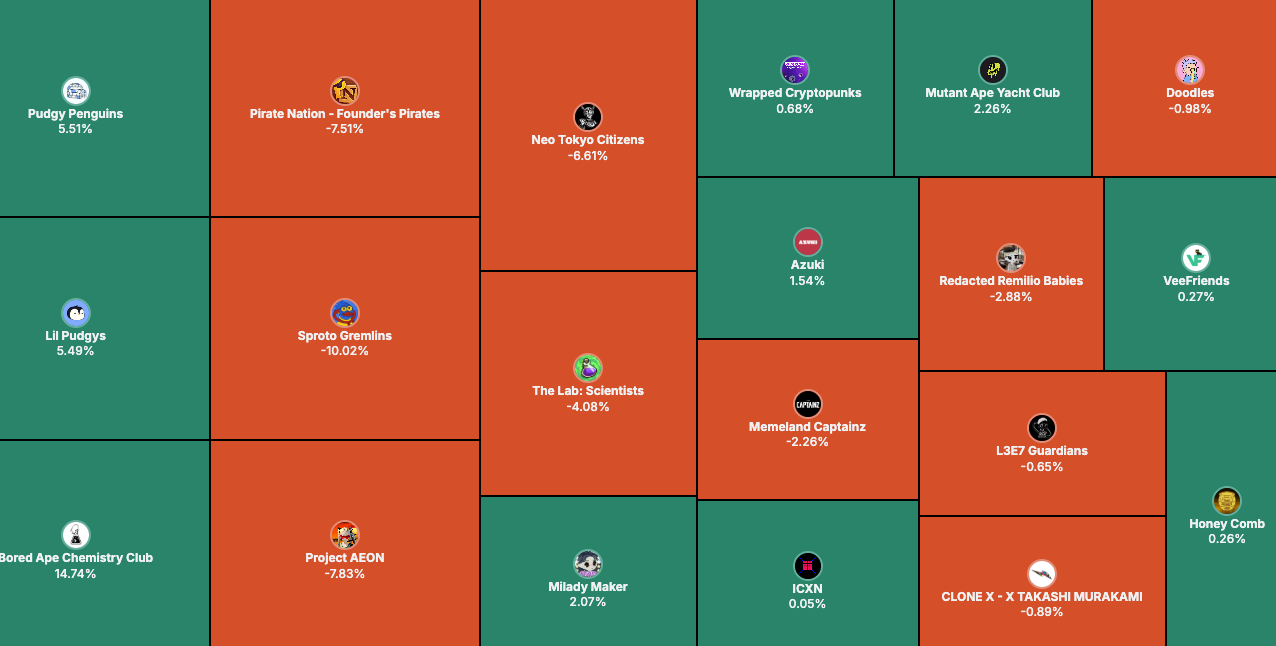

Bored Ape Chemistry floor moves on the recent sale of a Serum for $200k

Pudgy pumps as Abstract rumours surface

Meme NFTs cool off after a heated run

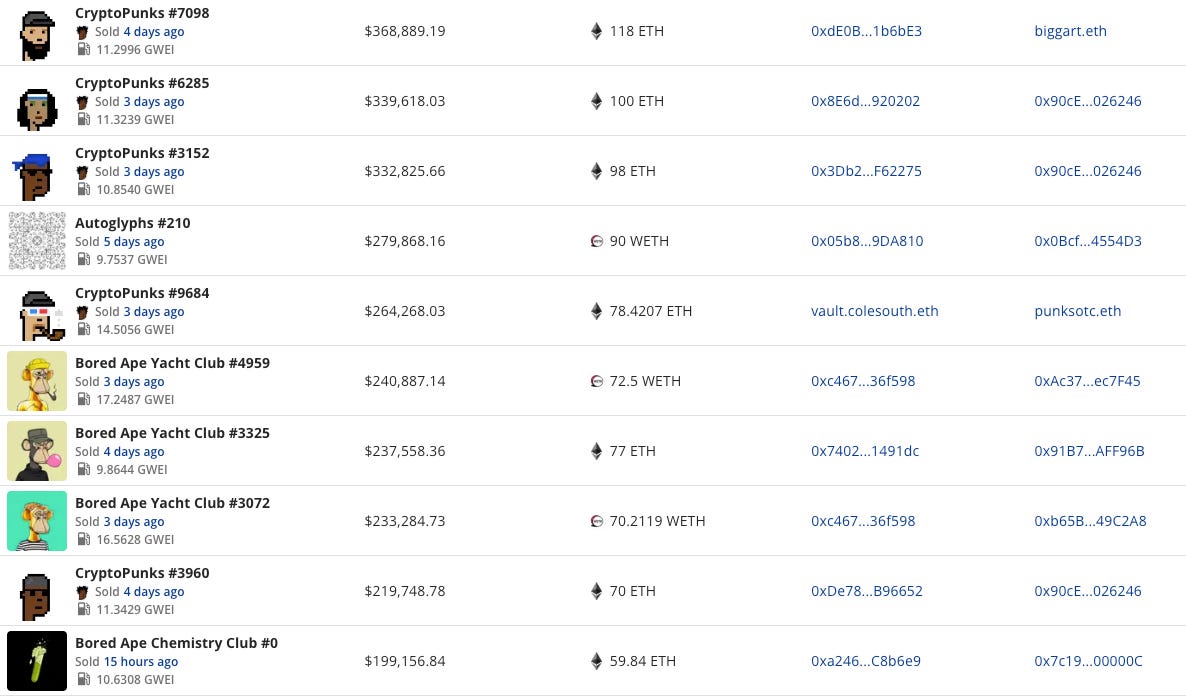

Notable NFT Sales

JRNY unfortunately loses two Gold Apes which are subsequently floored into WETH bids for below fair value

Yuga assets continue to trade at the high end of the market with Punks/Glyphs

BAYC Serum trades for $200k — only limited number remaining; the wallet collecting holds BAYC, Azukis, XCOPY and Remillios

New Participant Indicators

Institutional/Regulatory Developments

Crypto Headwinds

Sentiment around Pump Fun hits rock bottom as likelihood of U.S. seizing platform before 2025 hits 97% on Polymarket following inappropriate live streams

Other News

(H/t Mando’s Minutes)

That’s a wrap for issue 100 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

And if you thought this was interesting, please consider subscribing to this Substack and following me on Twitter for more on NFTs and Web 3.0.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets mentioned in this newsletter.